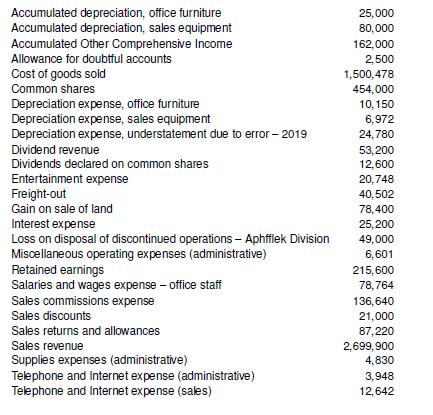

The following account balances were included in the adjusted trial balance of Spyder Inc. at September 30,

Question:

The following account balances were included in the adjusted trial balance of Spyder Inc.

at September 30, 2020. All accounts have normal balances:

Additional information:

The company follows IFRS and its income tax rate is 30%. On September 30, 2020, the number of common shares outstanding was 124,000 and no changes to common shares during the fiscal year. The depreciation error was due to a missed month-end accrual entry at August 31, 2019.

Required:

a. Prepare a multiple-step income statement in good form with all required disclosures by function and by nature for the year ending September 30, 2020.

b. Prepare a statement of changes in equity in good form with all required disclosures for the year ended September 30, 2020.

c. Prepare a single-step income statement in good form with all required disclosures by nature for the year ending September 30, 2020, assuming this time that the dividends declared account listed in the trial balance are for preferred shares instead of common shares.

d. Assuming that Spyder also recorded unrealized gains for FVOCI investments through OCI of $25,000, prepare a statement of comprehensive income for the company.

Step by Step Answer:

Intermediate Financial Accounting Volume 1

ISBN: 9781539980674

1st Edition

Authors: Glenn Arnold, Suzanne Kyle, Lyryx Learning