Jackson Ltd. is considering going public but is unsure of a fair offering price for the company.

Question:

Jackson Ltd. is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Jackson have decided to make their own estimate of the firm’s common stock value. The firm’s CFO has gathered data for performing the valuation using the free cash flow valuation model.

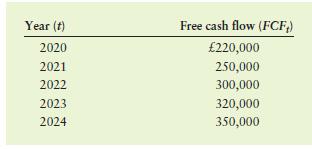

The firm’s weighted average cost of capital is 10%, and it has £200,000 of debt and £500,000 of preferred stock in terms of market value. The estimated free cash flows over the next five years appear below. Beyond 2024, the firm expects its free cash flow to grow by 4% per year forever.

a. Estimate the value of Jackson Ltd. by using the free cash flow valuation model.

b. Use your finding in part

a, along with the data provided above, to find Jackson Ltd.’s common stock value.

c. If the firm plans to issue 200,000 shares of common stock, what is its estimated value per share?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart