Randy & Whiskers Enterprises has 2021 sales of $15.5 million. It wishes to analyze expected performance and

Question:

Randy & Whiskers Enterprises has 2021 sales of $15.5 million. It wishes to analyze expected performance and financing needs for 2022.

You are requested to compile a pro forma balance sheet. Given the following information, respond to parts a and b.

(1) The balance sheet items vary directly with sales: accounts receivable (10%), inventory

(15%), accounts payable (10%), and net profit margin (2%).

(2) Marketable securities and other current liabilities are expected to remain unchanged.

(3) A minimum cash balance of $520,000 is desired.

(4) A new equipment costing $20,000 will be purchased during 2022, and a total depreciation in 2022 is forecast at $5,000.

(5) Accruals are expected to rise to $660,000.

(6) No sale or retirement of long-term debt is expected, and no common stock will be repurchased.

(7) The dividend payout of 50% of net profits is expected to continue.

(8) Sales are expected to decrease to $15,000,000.

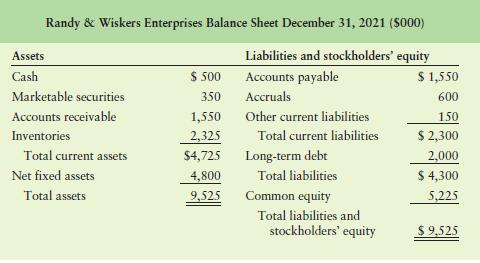

(9) The December 31, 2021, balance sheet follows.

Based on the information provided, answer the following:

a. Prepare a pro forma balance sheet dated December 31, 2022.

b. Discuss the financing changes suggested by the statement prepared in part a.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart