Theodora works as a financial analyst for Berrios S.A., a construction company headquartered in Athens, Greece. She

Question:

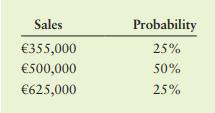

Theodora works as a financial analyst for Berrios S.A., a construction company headquartered in Athens, Greece. She has been asked to make an analysis of the possibilities of optimizing the capital structure of the company. She starts her analysis by making the following forecast of sales, with the associated probabilities of occurrence noted.

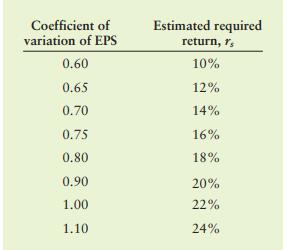

The company has fixed operating costs of €170,000 per year, and variable operating costs represent 50% of sales. The current capital structure consists of 20,000 shares of common stock that have a €20 per share book value. The marketplace has assigned the following required returns to risky earnings per share.

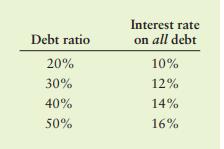

The company wants to shift the capital structure by increasing debt and decreasing common stock, in order to maximize EPS or shareholder value. The market has assigned four different debt ratios that are shown in the following table, along with an estimate, for each ratio, of the corresponding required interest rate on all debt.

The corporate tax rate in Greece is currently 29%. The market value of the equity for a leveraged firm can be found by using the simplified method.

a. Calculate the expected earnings per share (EPS), the standard deviation of EPS, and the coefficient of variation of EPS for the four proposed capital structures.

b. Determine the optimal capital structure, assuming (1) maximization of earnings per share and (2) maximization of share value.

c. Construct a graph showing the relationships in part b.

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart