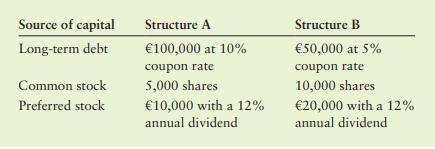

Suppose SpazioDatti is considering adding preferred stock to its capital structures. The key information is shown in

Question:

Suppose SpazioDatti is considering adding preferred stock to its capital structures. The key information is shown in the following table. Assume a 24% tax rate.

a. Calculate the EBIT-EPS coordinates for each of the structures for EBIT values of €30,000 and €40,000 with their associated EPS values.

b. Plot the two capital structures on a set of EBIT-EPS axes.

c. Discuss the leverage and risk aspects of each structure.

d. Indicate over what EBIT range, if any, each structure is preferred.

e. If the firm is fairly certain that its EBIT will exceed €42,000, which structure would you recommend? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart

Question Posted: