Total, nondiversifiable, and diversifiable risk Peter McGill randomly selected securities from those listed on the London Stock

Question:

Total, nondiversifiable, and diversifiable risk Peter McGill randomly selected securities from those listed on the London Stock Exchange for his portfolio.

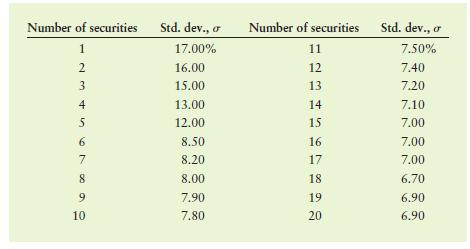

He began with a single security and added securities one by one until a total of 20 securities were held in the portfolio. After each security was added, David calculated the portfolio standard deviation, s. The calculated values are shown in the following table.

a. Plot the data from the table above on a graph that has the number of securities on the x-axis and the portfolio standard deviation on the y-axis.

b. Divide the total portfolio risk in the graph into its diversifiable and nondiversifiable risk components, and label each of these on the graph.

c. Describe which of the two risk components is the relevant risk, and explain why it is relevant. How much of this risk exists in Peter McGill’s portfolio?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart