You have a credit card debt amounting to $50,000. The card charges you a 32% interest rate

Question:

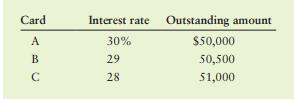

You have a credit card debt amounting to $50,000. The card charges you a 32% interest rate with monthly compounding. You believe that the interest rate of the existing debt is too high, so you decide to switch cards and move the outstanding balance on the old card to the new card. After doing some research, you find Cards A, B, and C as alternatives. If you move the existing debt to Card B or Card C, there will be extra charges (handling fees). Card B will charge $500, and Card C will charge $1,000 handling fees.

a. If you pay off the debt in one year with equal monthly amounts, how much in interest payments have you saved by using (1) Card A, (2) Card B, and (3) Card C rather than keeping your existing card?

b. Which card should you choose?

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart