DeForest Company had the following transactions for the month. Calculate the ending inventory dollar value for the

Question:

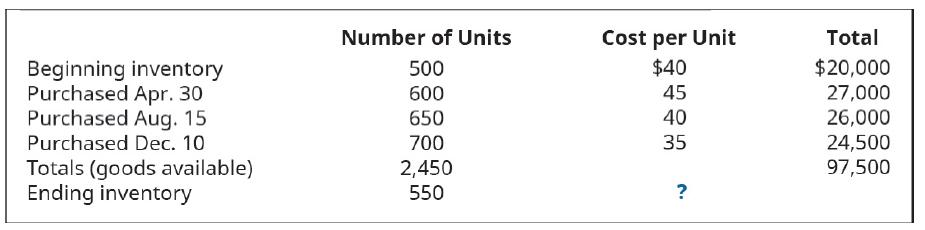

DeForest Company had the following transactions for the month.

Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations.

A. First-in, first-out (FIFO)

B. Last-in, first-out (LIFO)

C. Weighted average (AVG)

Transcribed Image Text:

Beginning inventory Purchased Apr. 30 Purchased Aug. 15 Purchased Dec. 10 Totals (goods available) Ending inventory Number of Units 500 600 650 700 2,450 550 Cost per Unit $40 45 40 35 2. Total $20,000 27,000 26,000 24,500 97,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (7 reviews)

A Firstin firstout FIFO method The FIFO method assumes that the oldest goods are sold first Using th...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Students also viewed these Business questions

-

Akira Company had the following transactions for the month. Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory...

-

DeForest Company had the following transactions for the month. Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory...

-

Trini Company had the following transactions for the month. Calculate the cost of goods sold dollar value for the period for each of the following cost allocation methods, using periodic inventory...

-

In what significant way do financial audits in government and not-for-profit organizations differ from those carried on in businesses? Your answer should also address the purpose of performance...

-

The following table lists the actual per-gallon prices for unleaded regular gasoline for June of each year between 1978 and 1986, together with the values of the CPIs for those years. For each year...

-

If possible, find AB and state the dimension of the result. 1. 2. 3. 4. 2 21 10 12 3 [3 5 B = 8. || AI 4 12 40 15 2 B = | 20 -7 30 11

-

6.1 .499 a. Consider the five varieties of apricot jelly. Identify the varieties for which you can conclude that the mean taste scores of the two protocols (SM and RR) differ significantly at a =...

-

McLain Corporation sold $6,000,000, 9%, 10-year bonds on January 1, 2014. The bonds were dated January 1, 2014 and pay interest on July 1 and January 1. McLain Corporation uses the straight-line...

-

AP 2 1 - 5 ( Regular HST Return ) Conan Doyle carries on a business as a sole proprietor. The business is located in Newfoundland and is called Conan's Comics. The business is carried on solely in...

-

The Porsche Club of America sponsors driver education events that provide high-performance driving instruction on actual racetracks. Because safety is a primary consideration at such events, many...

-

Assume your company uses the periodic inventory costing method, and the inventory count left out an entire warehouse of goods that were in stock at the end of the year, with a cost value of $222,000....

-

When inventory items are highly specialized, the best inventory costing method is ________. A. Specific identification B. First-in, first-out C. Last-in, first-out D. Weighted average

-

Holly Thompson has been operating a beauty shop in a university town for the past 10 years. Recently, Holly rented space next to her shop and opened a tanning salon. She anticipated that the costs...

-

Fineas Co. use the Job Order Costing system to determine product costs. Before entering 2020, the company has created a production budget, with an estimated total manufacturing overhead of $...

-

Define what a market value is? What are three major principles of investing funds? How does the federal government control the money supply? An investor purchases a 10-year U.S. Treasury note and...

-

1. Suppose we have two alternative designs, each of which yields a different present value of the total lifetime cost: the first is $1604 and the second is $1595. Verify that the present value of the...

-

Sometimes when we are asked for a linear model, the information that we are given is data about a scenario. In these cases we have to use Excel to generate a trendline. There is a video in this...

-

1. Purpose Explain 3 points from the Introduction section as to why this study is important. How did this study build on the existing literature in this area? 2. Participants Outline at least 2...

-

Simplify the expression. Express the answer so that all exponents are positive. Whenever an exponent is 0 or negative, we assume that the base is not 0. -2 x 4y1,

-

What is an insurable interest? Why is it important?

-

Why are expenses related to tax-exempt income disallowed?

-

Under what circumstances may a taxpayer deduct an illegal bribe or kickback?

-

Michelle pays a CPA $400 for the preparation of her federal income tax return. Michelles only sources of income are her salary from employment and interest and dividends from her investments. a. Is...

-

Which of the following statements regarding traditional cost accounting systems is false? a. Products are often over or under cost in traditional cost accounting systems. b. Most traditional cost...

-

Bart is a college student. Since his plan is to get a job immediately after graduation, he determines that he will need about $250,000 in life insurance to provide for his future wife and children...

-

Reporting Financial Statement Effects of Bond Transactions (please show me how you got the answers) Lundholm, Inc., which reports financial statements each December 31, is authorized to issue...

Study smarter with the SolutionInn App