Record the journal entries for each of the following payroll transactions. Apr. 2 Apr. 4 Apr. 11

Question:

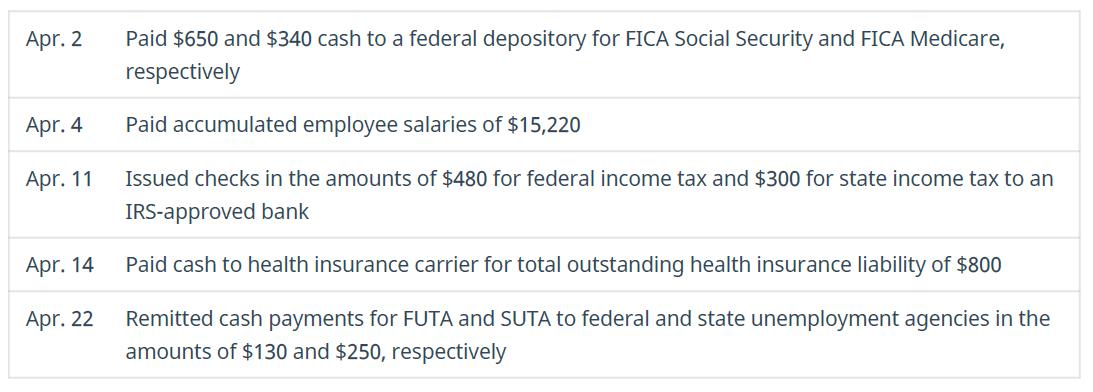

Record the journal entries for each of the following payroll transactions.

Transcribed Image Text:

Apr. 2 Apr. 4 Apr. 11 Apr. 14 Apr. 22 Paid $650 and $340 cash to a federal depository for FICA Social Security and FICA Medicare, respectively Paid accumulated employee salaries of $15,220 Issued checks in the amounts of $480 for federal income tax and $300 for state income tax to an IRS-approved bank Paid cash to health insurance carrier for total outstanding health insurance liability of $800 Remitted cash payments for FUTA and SUTA to federal and state unemployment agencies in the amounts of $130 and $250, respectively

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Apr 2 Paid 650 and 340 cash to a federal depository for FICA Social Security and FICA Medicare respe...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Record the journal entries for Stiller Co. on January 1, 2015 and December 31, 2015. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the...

-

Prepare journal entries for each of the following transactions entered into by the City of Loveland. Prepare journal entries for each of the following transactions entered into by the City of...

-

Record the journal entries for the following transactions March 10 500 units of raw materials were purchased on account at $550 per unit March 15 400 units of raw materials were requisitioned at $600...

-

What are the delta and gamma of an option?

-

Alpha Corporation purchased 20% of Theta Corporations stock on each of the following dates in the current year: January 2, April 1, June 1, October 1, and December 31. a. Has a qualified stock...

-

When 5-deutero-5-methyl-1,3-cyclopentadiene is warmed to room temperature, it rapidly rearranges, giving an equilibrium mixture containing the original compound as well as two others. Propose a...

-

1. What is the most important activity that your family does together?

-

Although the spec was for a Model XP server, Network Illusions delivered a newer model, called the DX+. The vendor sales rep said that performance would be the same or better, but the IT team decided...

-

17. Which is correct? Venture capital firms often help startups in accessing bank financing through use of their own credit Venture capital firms often form hedge funds to raise funds for investments...

-

During 2021, Brewster Company earned revenues of $146 million. Brewster incurred, during that same year, salary expense of $28 million, rent expense of $23 million, and utilities expense of $19...

-

What accounts are used to record a contingent warranty liability that is probable and estimable but has yet to be fulfilled? A. Warranty liability and cash B. Warranty expense and cash C. Warranty...

-

Blake Department Store sells television sets with one-year warranties that cover repair and replacement of television parts. In the month of June, Blake sells forty television sets with a per unit...

-

Draw resonance forms to show how the BHA radical is stabilized by delocalization of the radical electron over other atoms in the molecule.

-

Ranjha Inc. manufactures widgets. The end product is produced in different departments within the plant. One component, C1, is causing some concern. The component is integral to the production of...

-

. Write a Java program in NetBeans that creates a LinkedHashSet. Your Java program must use the methods in the LinkedHashSet interface to do the following: 2.1 Add the above elements into the...

-

on the following statement: Mona is an industrial engineer working for car parts manufacturing facility. She collected the following data on three alternatives of sustainable energy systems to be...

-

Alvarado Company produced 2,900 units of product that required 6 standard direct labor hours per unit. The standard fixed overhead cost per unit is $2.55 per direct labor hour at 16,200 hours, which...

-

Find the complexity of the function given below. void function(int n) { int i, count =0; for(i=1; i*i

-

On a basketball team of 12 players, 2 only play center, 3 only play guard, and the rest play forward (5 players on a team: 2 forwards, 2 guards, and 1 center). How many different teams are possible,...

-

A firm has the following balance sheet: Assets Cash Accounts receivable Inventory Plant and equipment $ 15,000 150,000 92,000 170,000 $427,000 Liabilities and Equity Accounts payable Long-term debt...

-

Overnight Publishing Company (OPC) has $1.7 million in excess cash. The firm plans to use this cash either to retire all of its outstanding debt or to repurchase equity. The firms debt is held by one...

-

Sam Dugan is the founder and CEO of Dugan Restaurants, Inc., a regional company. Sam is considering opening several new restaurants. Sally Thornton, the companys CFO, has been put in charge of the...

-

Ash, Inc., has declared a $7.25 per-share dividend. Suppose capital gains are not taxed, but dividends are taxed at 25 percent. New IRS regulations require that taxes be withheld at the time the...

-

Your firm is planning to invest in an automated packaging plant. Harburtin Industries is an all - equity firm that specializes in this business. Suppose Harburtin ' s equity beta is 0 . 8 7 , the...

-

Ned Allen opened a medical practice in Los Angeles, California, and had the following transactions during the month of January. (Click the icon to view the January transactions.) Journalize the...

-

do you need more information or are you working on this? Irene Watts and John Lyon are forming a partnership to which Watts will devote one- half time and Lyon will devote full time. They have...

Study smarter with the SolutionInn App