Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare journal entries for each of the following transactions entered into by the City of Loveland. Prepare journal entries for each of the following transactions

Prepare journal entries for each of the following transactions entered into by the City of Loveland.

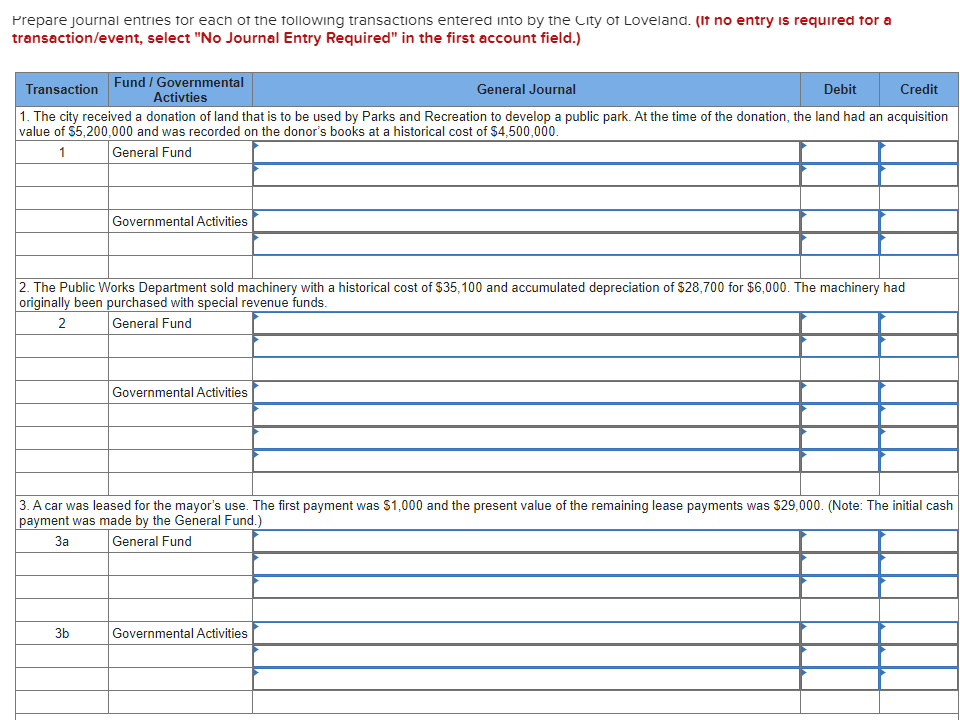

Prepare journal entries for each of the following transactions entered into by the City of Loveland. (If no entry is required tor a transaction/event, select "No Journal Entry Required" in the first account field.) Fund / Governmental Activties Transaction General Journal Debit Credit 1. The city received a donation of land that is to be used by Parks and Recreation to develop a public park. At the time of the donation, the land had an acquisition value of $5,200,000 and was recorded on the donor's books at a historical cost of $4,500,000. 1 General Fund Governmental Activities 2. The Public Works Department sold machinery with a historical cost of $35,100 and accumulated depreciation of $28,700 for $6,000. The machinery had originally been purchased with special revenue funds. 2 General Fund Governmental Activities 3. A car was leased for the mayor's use. The first payment was $1,000 and the present value of the remaining lease payments was $29,000. (Note: The initial cash payment was made by the General Fund.) General Fund 3b Governmental Activities

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Journal Entry for te Transactions entered Ento by the e ty of doveland SL NO FUND GOVT Ac TIV...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started