You are the audit manager of a medium-sized firm and have just received a package from Rachel

Question:

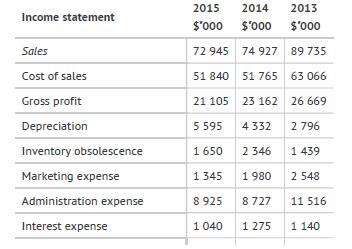

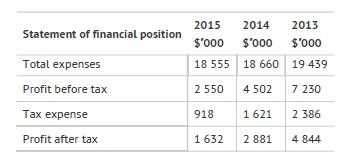

You are the audit manager of a medium-sized firm and have just received a package from Rachel Jones, the financial controller of Telechubbies Ltd, a toy manufacturer. This is your firm's first year as auditor of Telechubbies. The information contained in the statement of financial position and income statement overleaf was prepared for a board meeting and Rachel felt it might be useful to you in preparation of the forthcoming audit for the year ended 31 December 2015.

During a brief telephone call with Rachel, you made the following notes:

1. One of the conditions of the long-term loan is that the company is not to exceed a debt-toequity ratio of 2:1 at any time. The loan is reviewed each year on 31 December.

2. Provision against inventory obsolescence is provided for at a flat rate of 10%. The amount provided in previous years was 20%. Rachel said that the company believes it has been overly conservative in previous years and 5% is a more realistic level, given the nature of its products.

3. The long-term loan receivable is from a company involved in the development and production of computer software. It is owned by one of the directors.

Required

a. Suggest possible sources of information that would help you gather sufficient knowledge of the business to perform the audit of Telechubbies Ltd.

b. Perform preliminary analytical procedures using the information provided. Identify the key areas that would require special attention during the audit of the 31 December 2015 financial statements.

c. Outline ways in which the analytical procedures performed could be extended using the information collected in (a).

d. Suggest ways of using analytical procedures as a substantive test during the audit of Telechubbies Ltd.

Step by Step Answer:

Modern Auditing And Assurance Services

ISBN: 9781118615249

6th Edition

Authors: Philomena Leung, Paul Coram, Barry J. Cooper, Peter Richardson