You have just completed preliminary analytical procedures of your client Indonesia On-Line Ltd (IOL) which has a

Question:

You have just completed preliminary analytical procedures of your client Indonesia On-Line Ltd (IOL)

which has a 31 March year-end. IOL is involved in the development and design of new computer programs specifically for use on the Internet. The company was formed 5 years ago by a young entrepreneur, Mr Tinta, with equity provided by his parents and a few friends. Mr Tinta designed a program that was one of the first of its kind to assist users in the design of personalised web pages.

The program was user-friendly and cheaper than its competitors and therefore became very successful. The company has subsequently launched other Internet-related programs onto the market which have attracted, at best, moderate attention. Mr Tinta has told you that he is in the final stages of a new program that will help users in purchasing products over the Internet. The product has involved substantial research and development over the past 3 years. He is extremely excited about this new product and believes that sales will reverse any past trading problems they have had.

He has also told you that he has raised sufficient finance to enable finalisation and launch of the product within 6 months.

During the initial years where the company experienced rapid growth, all profits were reinvested to further research and development and to purchase an office block as the corporate headquarters.

Office space not required by the company is rented out to tenants on normal commercial terms.

Three small retail sites were also purchased that are used as outlets for the company's products as well as other computer software products. Mr Tinta believes that the market values are far in excess of the current carrying values.

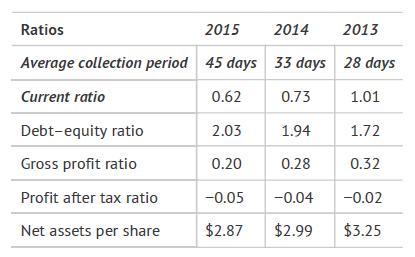

The results of the ratio analysis undertaken as part of the analytical procedures were:

Required

a. Discuss IOL's overall financial position with reference to the ratio analysis undertaken as part of the analytical procedures.

b. Nominate other factors listed above that may indicate that the company has going concern problems.

c. List factors that may help IOL resolve this going concern problem. Outline the information that you would need in relation to each factor identified.

Step by Step Answer:

Modern Auditing And Assurance Services

ISBN: 9781118615249

6th Edition

Authors: Philomena Leung, Paul Coram, Barry J. Cooper, Peter Richardson