(Statistics for assets and portfolio, finding the market portfolio, Sharpe ratio) Given the year-end prices of the...

Question:

(Statistics for assets and portfolio, finding the market portfolio, Sharpe ratio)

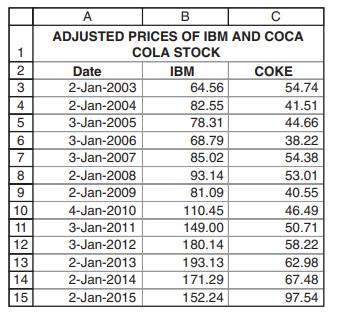

Given the year-end prices of the shares of IBM and Coca-Cola (COKE), answer the following questions:

a. For the years 2003–2014, calculate the following statistics for the two shares: average annual return, variance and standard deviation of returns, covariance of returns, and correlation coefficient.

b. Calculate the returns and standard deviations for portfolios composed of these two stocks.

c. Find the market portfolio using the Sharpe ratio, assuming the riskfree asset return is 4%.

d. Is your answer to part c the minimum variance portfolio? If not, calculate the Sharpe ratio of the minimum variance portfolio as well.

Step by Step Answer:

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi