ABC Hardware Company began 20x4 with 60,000 units of stock that cost 36,000. During 20x4, ABC purchased

Question:

ABC Hardware Company began 20x4 with 60,000 units of stock that cost £36,000.

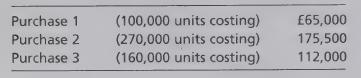

During 20x4, ABC purchased goods on credit for £352,500 as follows:

Cash payments to suppliers totalled £330,000 during the year.

ABC's sales during 20x4 consisted of 520,000 units of stock for £660,000, all on credit. The company uses the FIFO stock valuation method.

Cash collections from customers were £650,000. Operating expenses totalled £240,500, of which ABC paid £211,000 in cash by the end of the accounting year. At 31 December, ABC accrued income tax expense at the rate of 35 percent of income before tax.

Required

1 Make summary journal entries to record ABC hardware’s transactions for the year, assuming the company uses a perpetual inventory system.

2 Determine the FIFO cost of ABC’s closing stock at 31 December 20x4 in two ways:

a. using a T-account

b. multiplying the number of units on hand by the unit cost.

3 Show how ABC would compute cost of goods sold for 20x4.

4 Prepare ABC Hardware’s income statement for 20x4, including the calculation of the tax for the period.

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis