Celestica Inc. is a world leader in providing electronics manufacturing services to original equipment manufacturers, communications, and

Question:

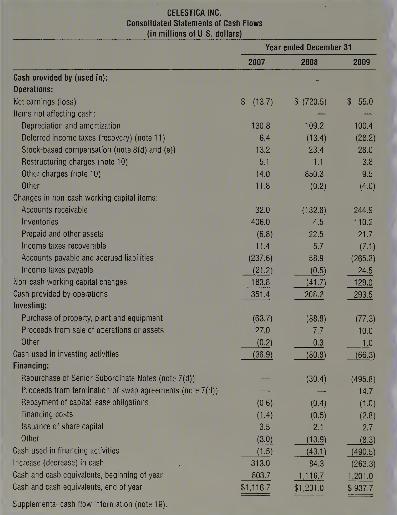

Celestica Inc. is a world leader in providing electronics manufacturing services to original equipment manufacturers, communications, and other industries. Celestica provides a wide variety of products and services to its customers, including complex printed circuit board assemblies such Celestica Inc. as PC motherboards and communication and networking cards. These assemblies end up in servers, workstations, personal computers, peripherals, and communications devices. Celestica also offers supply chain management, as well as design, global distribution, and post-sales repair services. Celestica operates facilities in the Americas, Europe, and Asia. Its statement of cash flows for the years 2007, 2008, and 2009 are shown on the following page.

Required:

1. The cash flows from operating activities show that "depreciation and amortization" is added to net earnings for 2009. Are depreciation and amortization sources of cash? Explain.

2. How does the change in inventory during 2009 affect cash? Explain.

3. Compare the changes in non-cash working capital items across the three years. What conclusions can you draw from this comparison?

4. Compute and analyze Celestica's capital acquisitions ratio and free cash flow for the three years.

5. Has Celestica become more or less risky during 2009? What other financial statement might include information that would help you confirm your answer? Explain.

6. Analyze the company's pattern of cash flows from operating, investing, and financing activities over the three years. What conclusion can you draw from the changing pattern of cash flows? Explain.

7. Obtain a copy of Celestica's statement of cash flows for the year 2010 through the company's website (www.celestica.com) or the SEDAR service (www.sedar.com). Did the company's cash flow situation in 2010 improve or deteriorate relative to previous years? Explain.

8. As a potential investor in Celestica's shares, what additional information would you need before making your decision as to whether or not to invest in this company's shares?

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby