Question:

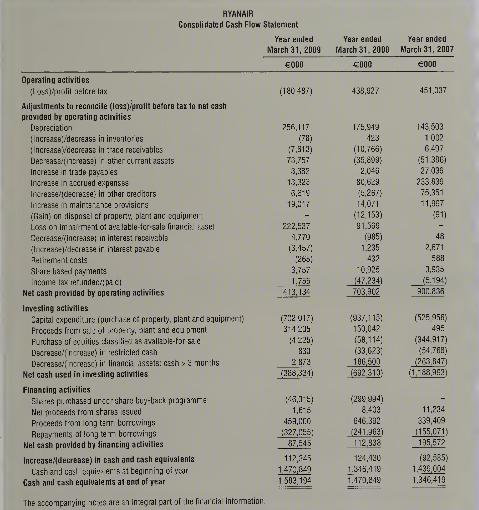

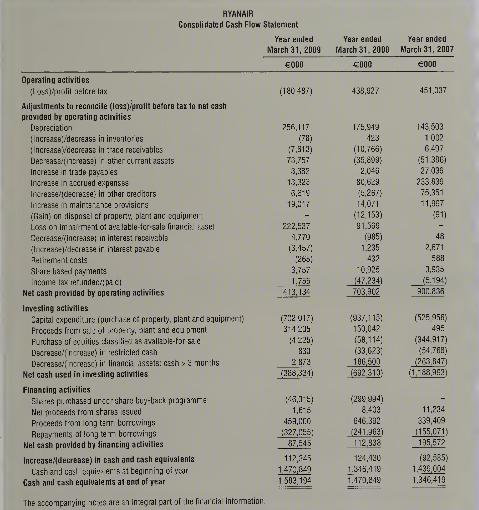

fly to about 150 destinations in more than 25 countries in Europe. Ryanair prepares its financial statements in accordance with International Financial Reporting Standards. Its statement of cash flows for fiscal years 2007, 2008, and 2009 are shown below.

Required:

1. The cash flows from operating activities show that "depreciation" is added to profit or loss before tax. Is depreciation a source of cash? Explain.

2. Ryanair reported operating revenues of \(€ 2,941,965\) during fiscal year 2009. Compute the amount of cash collected from customers during the year, assuming all sales are on account.

3. How does the change in trade payables during 2009 affect cash?

4. Did Ryanair expand during 2007, 2008, and 2009? If so, how did the company pay for its expansion Explain.

5. Compute and analyze Ryanair's quality of earnings ratio, capital acquisitions ratio, and free cash flow for the three years.

6. As a potential investor in Ryanair's shares, what additional information would you need before making your decision as to whether or not to invest in the company's shares?

Transcribed Image Text:

RYANAIR Consolidated Cash Flow Statement Operating activities solit aslcre lax Adjustments to reconcile (loss)/profit before tax 10 nat cash. Year ended March 31, 2009 Year ended March 31, 2000 Year ended March 31, 2007 000 000 000 (180497) 438,927 451,337 provided by operating activities Depreciation 256,117 175,949 143,503 increase/decrease in inventories (78) 123 1002 increase vdecrease in ace receivables (7,812) (10,766) 6.497 Decrease increase rather currant assets 73,757 (35,809) (51.396) Increase in trade payas 3,382 2,048 Increase in accrued expense 13,323 80,628 Increase/decrease; in other creditors 6,29 6.25/9 Increase in maintenance provisions 19,27 14,0/1 (Rain) on disposal of proper plant and equipier (12.153) 27 039 233.830 75,351 11,007 (61) Loss on Imament of avalable-for-sale financi. sel 222,537 $1.500 Decrease Increase; in interest receivable 1.779 (985) 48 Increase/decrease ir interest payable 13.16/ 1.235 2,671 Retirement costs 265 432 588 Stare based payments 3,707 0,925 1,535 income tax rer indep 1,755 (47.2341 Net cash provided by operating activities 13,130 703.002 (5194) 3 Investing activilles Capital expenditure (purchase of property, plant and equipment) (702017) 93/,113) (525956) Proceeds from sal opery, plant and ecu pent 3-4235 150,042 495 Purchase of cultius dass li- as available-for-sa 12250 (38,114 (344.917) Decrease(ncrease) in restricted cash 833 (33,623 (54.76) Decrease(ncrease) ir linancia assets: cash >mur hs 2873 106,500 203.847) Net cash used in investing activities 288,321) (592 313 1,188,963) Financing activities Seres p. chased urce share buy-back pagame Nel proceeds fron shares issued Proceeds from long tent berrowings Repayments af tong ter borrowings Nel cash provided by financing activities Increase, decrease) in cash and cash equivalents (280 994) 1,6-5 8.433 11,234 453,00 646.302 339,409 327,5 (241.963) 1155,071) 87,545 112,938 135,572 112,345 124,130 182,585) Cash and cas qui ers at beginning of your 1473,849 1.345,110 1.430.004 Cash and cash equivale mts at and of year 1 503,194 1.170,249 1,346,419 The accompanying ces are an integral part of the financial Information.