Katherine prepares accounts to 31 May each year. On 1 June 1998 her ledger included the following

Question:

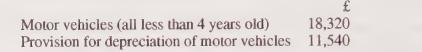

Katherine prepares accounts to 31 May each year. On 1 June 1998 her ledger included the following balances:

On 1 September 1998, Katherine bought a new motor vehicle for £9,400, paying by cheque. On the same day, she sold for £3,350 a vehicle which she had bought originally on 1 December 1995 for £7,200. Katherine depreciates her motor vehicles at a rate of 20% per annum using the straight-line method.

Required:

(a) Prepare relevant ledger accounts for the year to 31 May 1999, assuming that a full year's depreciation is charged in the year in which a vehicle is acquired and that no depreciation is charged in the year of disposal.

(b) How would your answer differ if partial depreciation charges were made in the years of acquisition and disposal?

Step by Step Answer: