REVENUES, CASH FLOWS, AND ADJUSTMENTS. Sacks Business Supply rents office copiers to small businesses. Some customers prepay

Question:

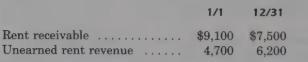

REVENUES, CASH FLOWS, AND ADJUSTMENTS. Sack’s Business Supply rents office copiers to small businesses. Some customers prepay their rentals, while others are billed by Sack’s periodically for rent owed. The following data are available for rent revenues received in advance and for rent receivable at January 1 and December 31:

During the year, Sack’s Business Supply received $88,600 in cash for copier rentals ($9,100 of which was for the January 1 receivable). Another $10,400 was from customers who prepay their copier rentals. During the year, the $4,700 of unearned rent revenue was earned, and $6,200 of the $10,400 was unearned at year-end.

REQUIRED:

1. Determine the amount of rent revenue earned during the year.

2. If the $88,600 of cash received for rentals is credited in full to unearned rent rev- enue, what is the necessary adjusting entry at December 31? Prepare T-accounts to support your answer.

3. If $9,100 of the $88,600 is credited to rent receivable, $10,400 is credited to unearned rent revenue, and the remaining $69,100 is credited to rent revenue, what is the necessary adjusting entry at December 31? Prepare T-accounts to support your answer.

Step by Step Answer: