Steven Cheng, the sole shareholder and manager of Musical Instruments Ltd. (MIL), has approached you and asked

Question:

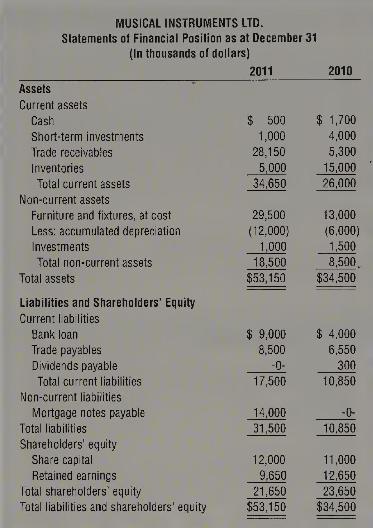

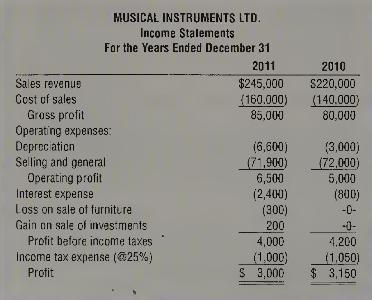

Steven Cheng, the sole shareholder and manager of Musical Instruments Ltd. (MIL), has approached you and asked you to prepare a statement of cash flows for his company. MIL sells different types of flutes and wind instruments to bands, orchestras, and music stores. Steven is presently worried about the meeting that he has scheduled in two weeks with a lending officer of his bank. It is time for a review of the bank loan. This also involves a review of MIL's profitability and financial position.Steven provided you with the following condensed financial statements for the fiscal years ended December 31, 2010 and 2011. He assures you that the financial statements are free of any omissions or misstatements, and that they conform to IFRS.

Additional information:

a. In 2011, MIL sold older obsolete furniture with an original cost of \(\$ 1,000\) and accumulated depreciation of \(\$ 600\) up to the date of sale.

b. During 2011, one of the non-current investments that had cost \(\$ 500\) was sold at a gain of \(\$ 200\).

c. The company considers short-term investments as cash equivalents.

Required:

1. Prepare a statement of cash flows for MIL for the year ended December 31, 2012. Use the indirect method to report cash flows from operating activities.

2. Using the statement of cash flows you prepared in (1), compute and explain each of the following:

(a) quality of earnings ratio,

(b) capital acquisitions ratio, and

(c) free cash flow.

3. In an effort to improve the company's financial performance, Steven Cheng proposed that the furniture and fixtures be amortized over a longer period. This change will decrease depreciation expense by \(\$ 1,000\) in 2010 and by \(\$ 2,000\) in 2011 . As a professional accountant, would this proposed change be acceptable to you? Explain.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby