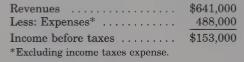

TEMPORARY DIFFERENCES AND INCOME TAX LIABILITIES. Delray Manufacturing has the following income statement data available for 19x8:

Question:

TEMPORARY DIFFERENCES AND INCOME TAX LIABILITIES. Delray Manufacturing has the following income statement data available for 19x8:

Delray’s expenses include straight-line depreciation of $67,400; depreciation deducted on the 19x8 tax return amounted to $95,000. All other revenues and expenses are the same on the tax return and the income statement. Delray’s income tax rate is 34%.

The balance of income taxes payable was $7,400 on January 1, 19x8, representing the unpaid portion of 19x7 income taxes. This amount was paid during April 19x8. In addition, 19x8 taxes were prepaid at various times during 19x8 in the total amount of $36,500. The balance of the deferred income tax liability was $15,700 on January 1, 19x8.

REQUIRED:

1. Compute the income taxes expense for 19x8.

2. Compute the taxable income and the amount of income taxes assessed for 19x8.

3. Prepare the journal entries related to income taxes that would be recorded during 19x8.

Step by Step Answer: