The Elite Livery Service, Inc., was organized to provide limousine service between the airport and various suburban

Question:

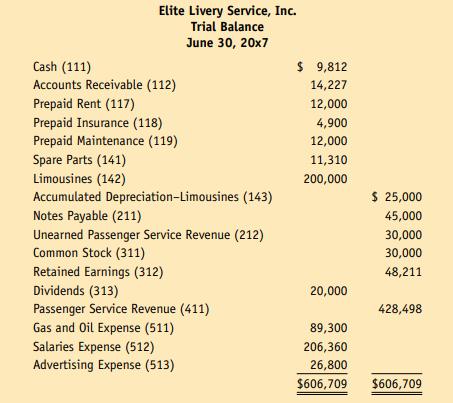

The Elite Livery Service, Inc., was organized to provide limousine service between the airport and various suburban locations. It has just completed its second year of business. Its trial balance appears at the top of the next page. The following information is also available:

a. To obtain space at the airport, Elite paid two years’ rent in advance when it began the business.

b. An examination of insurance policies reveals that $2,800 expired during the year.

c. To provide regular maintenance for the vehicles, Elite deposited $12,000 with a local garage. An examination of maintenance invoices reveals charges of $10,944 against the deposit.

d. An inventory of spare parts shows $1,902 on hand.

e. Elite depreciates all of its limousines at the rate of 12.5 percent per year.

No limousines were purchased during the year.

f. A payment of $10,500 for one full year’s interest on notes payable is now due.

g. Unearned Passenger Service Revenue on June 30 includes $17,815 for tickets that employers purchased for use by their executives but which have not yet been redeemed.

h. Federal income taxes for the year are estimated to be $12,000.

Required 1. Determine adjusting entries and enter them in the general journal (Page 14).

2. Open ledger accounts for the accounts in the trial balance plus the following: Interest Payable (213); Income Taxes Payable (214); Rent Expense (514); Insurance Expense (515); Spare Parts Expense (516); Depreciation Expense–Limousines (517); Maintenance Expense (518); Interest Expense (519); and Income Taxes Expense (520). Record the balances shown in the trial balance.

3. Post the adjusting entries from the general journal to the ledger accounts, showing proper references.

4. Prepare an adjusted trial balance, an income statement, a statement of retained earnings, and a balance sheet.

5. User insight: Do adjustments affect the profit margin? After the adjustments, is the profit margin for the year more or less than it would have been if the adjustments had not been made?

Alternate Problems Determining Adjustments

Step by Step Answer: