The trial balance of Burn Ltd. as at 31.12.X9 was as follows: The following additional information is

Question:

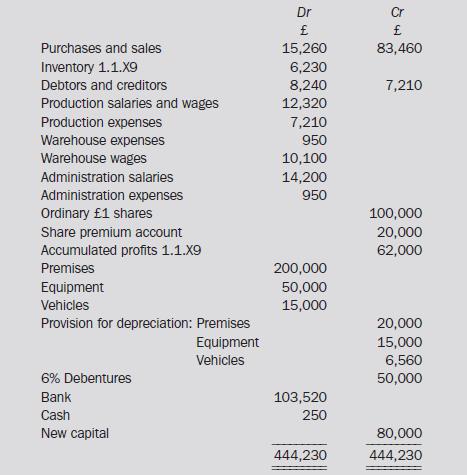

The trial balance of Burn Ltd. as at 31.12.X9 was as follows:

The following additional information is available none of which has been accounted for in the trial balance:

• Inventory 31.12.X9 £4,560.

• Premises and equipment are used 50% production, 25% distribution and 25%

administration and are depreciated at the rate of 2% and 10% respectively.

• Vehicles are only used by distribution and are depreciated at 25% reducing balance.

• A provision for bad debts of 5% is to be made.

• The new capital consists of the issue on 1.12.X9 of 40,000 £1 shares; the ledger clerk did not know how to treat this item in the ledgers.

• Tax for the year is estimated at £1,200.

• A vehicle, purchased 1.1.X7 for £7,000 was sold on 1.8.X9 for £3,750. The proceeds had been credited to sales.

• 5% Debentures were issued on 1.1.X9, par value £10,000, for £9,500. The £9,500 has been credited to accumulated profits 1.1.X9 account.

Prepare the income statement and the balance sheet for Burn Ltd. as at 31.12.X9 in a form suitable for publication.

Step by Step Answer: