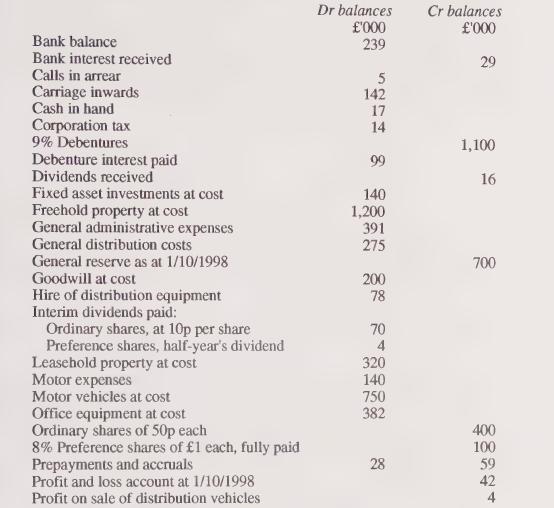

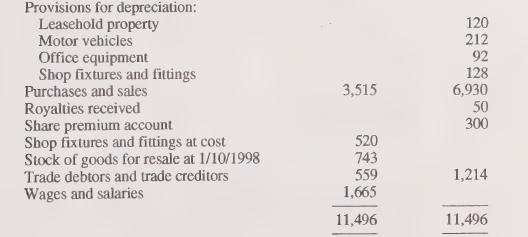

The trial balance of Greenacre plc as at 30 September 1999 (in alphabetical order) is as follows:

Question:

The trial balance of Greenacre plc as at 30 September 1999 (in alphabetical order) is as follows:

The following information is also available:

1. On 30 September 1999, the freehold property was valued at £2,000,000 by W Atkinson & Co (a firm of Chartered Surveyors). The directors have decided to incorporate this valuation into the company's accounts.

2. The company has a 40-year lease on the leasehold property.

3. Motor vehicles costing £85,000 were purchased during the year and vehicles costing £80,000 (accumulated depreciation to 30/9/98 £32,000)

were sold during the year for £52,000. Office equipment was bought during the year for £72,000. There were no other fixed asset acquisitions or disposals during the year. All of the acquisitions and disposals were properly accounted for before extracting the above trial balance.

4. Depreciation charges for the year to 30 September 1999 have not yet been calculated. Depreciation rates are as follows:

It is company policy to charge a full year's depreciation in the year of acquisition and none in the year of disposal. None of the fixed assets had been fully depreciated by 30 September 1998.

5. The leasehold property is used entirely for administrative purposes. The motor vehicles (and the motor expenses) are split 60:40 between distribution and administration.

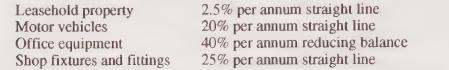

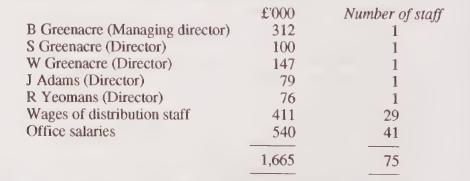

6. All of the investments are listed on the Stock Exchange. Their market value at 30 September 1999 was £172,000.

7. Closing stock on 30 September 1999 is valued at £727,000.

8. Trade debtors include £20,000 which is not payable until 31 October 2000. All of the trade creditors are payable within 30 days.

9. The debentures are redeemable in 7 years' time and are secured by a charge on the company's freehold property.

10. The audit fee of £14,000 is included in "General administrative expenses".

11. Wages and salaries may be analysed as follows:

12. The company issued 100,000 5Op ordinary shares on 31 August 1999 at an issue price of £2.50 per share. These new shares were not eligible for any dividends declared for the year to 30 September 1999. A total of £245,000 had been received in relation to this issue by 30 September 1999. No preference shares were issued during the year.

13. The balance on the corporation tax account represents an underprovision in the year to 30 September 1998. The corporation tax liability for the year to 30 September 1999 is estimated to be £95,000.

14. The directors propose to transfer £100,000 from the general reserve, to pay the remaining half-year's dividend on the preference shares and to pay a final ordinary dividend of 25p per share.

Required:

Insofar as the information permits, prepare Greenacre plc's profit and loss account for the year to 30 September 1999 and balance sheet as at that date in a form suitable for publication (using Format 1). The accounts should be accompanied by a set of formal notes but a statement of accounting policies is not required.

Step by Step Answer: