You work for a wholesale firm that distributes a single product. A trainee has prepared accounts for

Question:

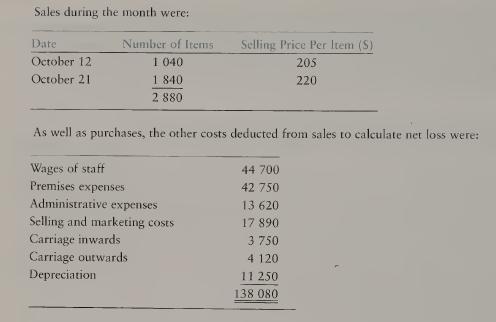

You work for a wholesale firm that distributes a single product. A trainee has prepared accounts for the month of October 2010. The accounts report a net loss of $35 580 and total net assets of $283 468. You have noted that:

i. The statement of comprehensive income does not report a figure for gross profit.

ii. The trainee has not included any value for closing inventory.

iii. The trainee has included $57 600 for opening inventory. This was calculated on the first-in, first-out (FIFO) basis. There were 480 items, valued at $120 per item.

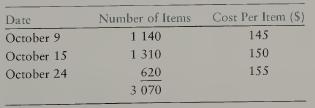

Purchases during the month were:

Required:

(a) Calculate:

i. The number of items in inventory at 31 October 2010.

ii. The value of inventory at 31 October 2010 on the FIFO basis.

(b) Using the revised inventory value calculated in (a), calculate:

i. Cost of sales for October 2010.

ii. Gross profit for October 2010. hi. Net profit for October 2010.

iv. Net assets at 31 October 2010. [ACCA adapted]

Step by Step Answer: