Grimes Corporation began business in 2017 and incurred losses for its first two years. In 2019, it

Question:

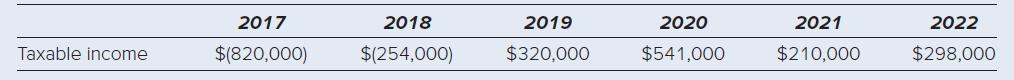

Grimes Corporation began business in 2017 and incurred losses for its first two years. In 2019, it became profitable. The following table shows Grimes’s taxable income before consideration of its NOLs:

Recompute Grimes’s taxable income for 2019 through 2022 after its allowable net operating loss deduction.

Transcribed Image Text:

Taxable income 2017 $(820,000) 2018 $(254,000) 2019 $320,000 2020 $541,000 2021 $210,000 2022 $298,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

Grimes 2017 NOL is not subject to the 80 limitation and is t...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted:

Students also viewed these Business questions

-

TRW Inc. began business in 2019 and incurred net operating losses for its first two years. In 2021, it became profitable. The following table shows TRWs taxable income before consideration of these...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

TRW Inc. began business in 2018 and incurred net operating losses for its first two years. In 2020, it became profitable. The following table shows TRWs taxable income before consideration of these...

-

The mass of the crane?s boom is 9000 kg. Its weight acts at?G. The sum of the moments about?P?due to the boom?s weight, the force exerted at?B?by the cable?AB,?and the force exerted at?C?by the...

-

The Heartland Produce Company owns farms in the Midwest, where it grows and harvests potatoes. It then ships these potatoes to three processing plants in St. Louis, New Orleans, and Chicago, where...

-

Verify that the given point is on the curve and find the lines that are (a) Tangent (b) Normal to the curve at the given point. y = 2sin(px - y), (1, 0)

-

LCV is the difference between standard cost of labour and (a) Variable cost (b) Fixed cost (c) Actual cost of labour (d) Marginal cost of labour

-

A company studied the number of lost-time accidents occurring at its Brownsville, Texas, plant. Historical records show that 6% of the employees had lost-time accidents last year. Management believes...

-

Not sure what's the last two column needs Salud Company reports the following information. Selected Annual Income Statement Data Net income $ 480,000 Depreciation expense 94,500 Gain on sale of...

-

LSG Company is a calendar year, cash basis taxpayer. On November 1, 2022, LSG paid $9,450 cash to the janitorial service firm that cleans LSGs administrative offices and retail stores. How much of...

-

Extronic, a calendar year, accrual basis corporation, reported a $41,900 liability for accrued 2021 state income tax on its December 31, 2021, balance sheet. Extronic made the following state income...

-

Under what conditions would a permanent supply shock cause a temporary increase in the inflation rate? If these conditions exist, are there any permanent effects of the supply shock on the economy?

-

The accounting records of the Eco Paper Company include the following information relating to the current year ended 31 March 2023: Materials 31 March 2023 $20,000 1 April 2022 $25,000 Work in...

-

The first read is an article on the development of money of a World War II prisoner-of-war, which was published in 1945. The second article was published in the opinion section of the New York Times...

-

Describe each Speaker's basic assumptions regarding employee motivation. That is, what are the underlying principles which guide how the Speaker treats his/her people (i.e., their direct report...

-

Find the area of the shaded region. The graph to the rate of IQ scores of adults, and those scores are normally distributed with the mean of 100 and a standard deviation of 15. x=81

-

In which scenario is Nikki showing resilience to stress? Nikki lost her job as an engineer 3 months ago. At first, she was depressed, but she realized she wanted to change career paths and decided to...

-

The statement of financial position of House Construction Co. for June 30, 2015 and 2014, is as follows: The following additional information was taken from the records of House Construction Co.: a....

-

Determine the center and radius of each circle. Sketch each circle. 4x 2 + 4y 2 9 = 16y

-

In your own words, explain why the book suggests that you should think of marketing strategy planning as a narrowing-down process.

-

Explain the major differences among the four basic types of growth opportunities discussed in the text and cite examples for two of these types of opportunities.

-

Explain why a firm may want to pursue a market penetration opportunity before pu r suing one involving product development or diversification.

-

Your company produces a health magazine. Its sales data for 1 - year subscriptions are as follows: Year of Operation Subscriptions Sold % Expired at Year End 2 0 2 0 $ 3 0 0 , 0 0 0 5 2 0 2 1 $ 6 4 7...

-

Problem 3 - 2 0 ( Static ) Calculate profitability and liquidity measures LO 3 - 3 , 3 - 4 , 3 - 6 Presented here are the comparative balance sheets of Hames Incorporated at December 3 1 , 2 0 2 3...

-

3 Required information [The following information applies to the questions displayed below) John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter. Samantha. In 2020,...

Study smarter with the SolutionInn App