Question

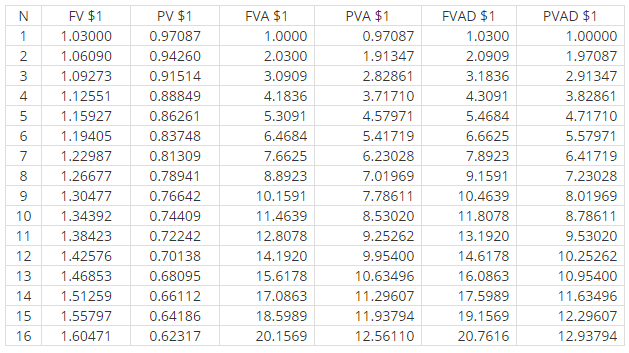

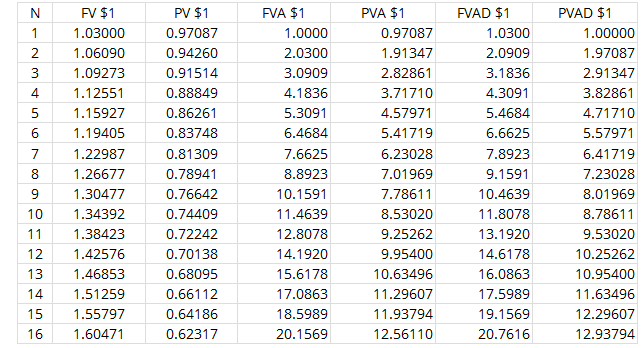

1. Present and future value tables of $1 at 3% are presented below Today, Thomas deposited $160,000 in a 3-year, 12% CD that compounds quarterly.

1. Present and future value tables of $1 at 3% are presented below

Today, Thomas deposited $160,000 in a 3-year, 12% CD that compounds quarterly. What is the maturity value of the CD?

A. $174,400.

B. $228,122.

C. $342,182.

D. $308,132.

2. Present and future value tables of $1 at 3% are presented below:

Jose wants to cash in his winning lottery ticket. He can either receive twelve, $8,000 annual payments starting today, or he can receive a lump-sum payment now based on a 3% annual interest rate. What would be the lump-sum payment?

A. $82,021.

B. $77,911.

C. $80,300.

D. $79,632.

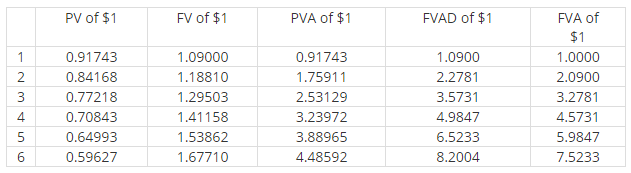

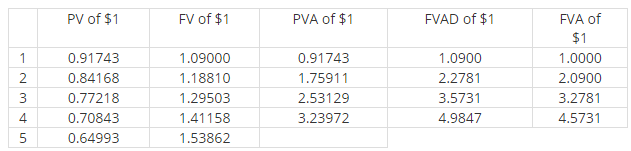

3. Present and future value tables of 1 at 9% are presented below.

Ajax Company purchased a two-year certificate of deposit for its building fund in the amount of $200,000. How much should the certificate of deposit be worth at the end of two years if interest is compounded at an annual rate of 9%?

A. $350,563.

B. $236,361.

C. $237,620.

D. $351,822.

4. Present and future value tables of 1 at 9% are presented below.

FV $1 1.03000 2 1.06090 Z- N 1 WN 3 1.09273 1.12551 1.15927 1.19405 1.22987 1.26677 9 1.30477 10 1.34392 11 1.38423 12 1.42576 13 1.46853 14 1.51259 4567 15 1.55797 16 1.60471 PV $1 0.97087 0.94260 0.91514 0.88849 0.86261 0.83748 0.81309 0.78941 0.76642 0.74409 0.72242 0.70138 0.68095 0.66112 0.64186 0.62317 FVA $1 1.0000 2.0300 3.0909 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 12.8078 14.1920 15.6178 17.0863 18.5989 20.1569 PVA $1 0.97087 1.91347 2.82861 3.71710 4.57971 5.41719 6.23028 7.01969 7.78611 8.53020 9.25262 9.95400 10.63496 11.29607 11.93794 12.56110 FVAD $1 1.0300 2.0909 3.1836 4.3091 5.4684 6.6625 7.8923 9.1591 10.4639 11.8078 13.1920 14.6178 16.0863 17.5989 19.1569 20.7616 PVAD $1 1.00000 1.97087 2.91347 3.82861 4.71710 5.57971 6.41719 7.23028 8.01969 8.78611 9.53020 10.25262 10.95400 11.63496 12.29607 12.93794 N FV $1 1 1.03000 2 1.06090 3 1.09273 4 1.12551 5 1.15927 6 1.19405 7 1.22987 8 1.26677 9 1.30477 10 1.34392 11 1.38423 12 1.42576 13 1.46853 14 1.51259 1.55797 1.60471 15 16 PV $1 0.97087 0.94260 0.91514 0.88849 0.86261 0.83748 0.81309 0.78941 0.76642 0.74409 0.72242 0.70138 0.68095 0.66112 0.64186 0.62317 FVA $1 1.0000 2.0300 3.0909 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 12.8078 14.1920 15.6178 17.0863 18.5989 20.1569 PVA $1 0.97087 1.91347 2.82861 3.71710 4.57971 5.41719 6.23028 7.01969 7.78611 8.53020 9.25262 9.95400 10.63496 11.29607 11.93794 12.56110 FVAD $1 1.0300 2.0909 3.1836 4.3091 5.4684 6.6625 7.8923 9.1591 10.4639 11.8078 13.1920 14.6178 16.0863 17.5989 19.1569 20.7616 PVAD $1 1.00000 1.97087 2.91347 3.82861 4.71710 5.57971 6.41719 7.23028 8.01969 8.78611 9.53020 10.25262 10.95400 11.63496 12.29607 12.93794 1 2 ~34 In 5 6 PV of $1 0.91743 0.84168 0.77218 0.70843 0.64993 0.59627 FV of $1 1.09000 1.18810 1.29503 1.41158 1.53862 1.67710 PVA of $1 0.91743 1.75911 2.53129 3.23972 3.88965 4.48592 FVAD of $1 1.0900 2.2781 3.5731 4.9847 6.5233 8.2004 FVA of $1 1.0000 2.0900 3.2781 4.5731 5.9847 7.5233 1 2 ~345 PV of $1 0.91743 0.84168 0.77218 0.70843 0.64993 FV of $1 1.09000 1.18810 1.29503 1.41158 1.53862 PVA of $1 0.91743 1.75911 2.53129 3.23972 FVAD of $1 1.0900 2.2781 3.5731 4.9847 FVA of $1 1.0000 2.0900 3.2781 4.5731

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Maturity Value160000 x FV1 at N4 Maturity Value160000 x 142576228122 2 In thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started