Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which of the following statements is incorrect? 2. Identify a disadvantage of being an S corporation. 3. The maximum number of actual shareholders in

1. Which of the following statements is incorrect?

2. Identify a disadvantage of being an S corporation.

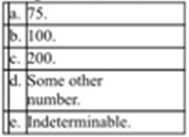

3. The maximum number of actual shareholders in an S corporation is:

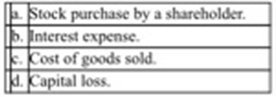

4. Which item has no effect on an S corporation? AAA?

a. The number of owners of an LLC is not limited. b. If the LLC has three or more corporate characteristics, it will be taxed as a C corporation. c. An LLC can elect to be taxed as a C corporation or as a partnership. d. Only a. and c. e. a., b., and c. are incorrect. Estates can be shareholders. b. Losses flow through immediately to the shareholders. The AMT on corporations is avoided. d. Tax-exempt income flows through as excludible to shareholders. e. None of the above is a disadvantage of the S election. 75. b. 100. . 200. d. Some other number. e. Indeterminable. 9F a. Stock purchase by a shareholder. b. Interest expense. Cost of goods sold. d. Capital loss.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 b is Incorrect ReasonA multiowner LLC is automatically taxed as a partnership by default while LLC...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started