Question

A company has three employees, each of whom has been employed since January 1, earns $3,350 per month, and is paid on the last day

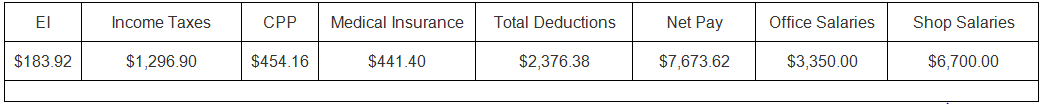

A company has three employees, each of whom has been employed since January 1, earns $3,350 per month, and is paid on the last day of each month. On March 1, the following accounts and balances appeared in its ledger. a. Employees? Income Taxes Payable, $1,296.90 (liability for February). b. EI Payable, $509.70 (liability for February). c. CPP Payable, $857.10 (liability for February). d. Employees? Medical Insurance Payable, $1,860.00 (liability for January and February). During March and April, the company completed the following related to payroll. Mar. 17 Issuedcheque #320 payable to the Receiver General for Canada. The cheque was in payment of the February employee income taxes, EI, and CPP amounts due. Mar. 31 Prepared a general journal entry to record the March payroll register, which had the following column totals:  Mar, 31 Recorded the employer?s $441.40 liability for its 50% contribution to the medical insurance plan of employees and 6% vacation pay accrued to the employees. Mar, 31 Prepared a general journal entry to record the employer?s costs resulting from the March payroll. Apr. 17 Issuedcheque #525 payable to the Receiver General for Canada in payment of the March mandatory deductions. Apr. 17 Issued cheque #526 payable to All Canadian Insurance Company in payment of the employee medical insurance premiums for the first quarter. Required: Prepare the entries to record the transactions.

Mar, 31 Recorded the employer?s $441.40 liability for its 50% contribution to the medical insurance plan of employees and 6% vacation pay accrued to the employees. Mar, 31 Prepared a general journal entry to record the employer?s costs resulting from the March payroll. Apr. 17 Issuedcheque #525 payable to the Receiver General for Canada in payment of the March mandatory deductions. Apr. 17 Issued cheque #526 payable to All Canadian Insurance Company in payment of the employee medical insurance premiums for the first quarter. Required: Prepare the entries to record the transactions.

$183.92 Income Taxes $1,296.90 CPP Medical Insurance $454.16 $441.40 Total Deductions $2,376.38 Net Pay $7,673.62 Office Salaries $3,350.00 Shop Salaries $6,700.00

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Date Account Title Debit Credit 17Mar Employees Income Tax...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started