Question

Assume that you recently graduated and landed a job as a financial planner with Cicero Services, an investment advisory company. The Client presently owns a

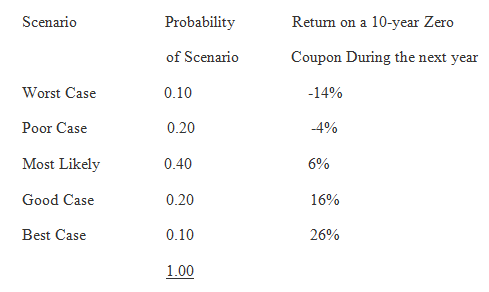

Assume that you recently graduated and landed a job as a financial planner with Cicero Services, an investment advisory company. The Client presently owns a bond portfolio with $1 million invested in zero coupon Treasury bonds that mature in 10 years. (The total par value at maturity is $1.79 million and yield to maturity is about 6%, but that information is not necessary for the mini case.) You have calculated the rate of return on 10-year zero coupon for each scenario.

The Risk Free Rate is 4% and the market risk premium is 5%

Use the scenario data to calculate the expected rate of return for the 10-year zero coupon Treasury bonds during the next year.

Scenario Worst Case Poor Case Most Likely Good Case Best Case Probability of Scenario 0.10 0.20 0.40 0.20 0.10 1.00 Return on a 10-year Zero Coupon During the next year -14% -4% 6% 16% 26%

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

6th edition

1305637100, 978-1305637108

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App