Question

Assume that you recently graduated and landed a job as a financial planner with Cicero Services, an investment advisory company. The Client presently owns a

Assume that you recently graduated and landed a job as a financial planner with Cicero Services, an investment advisory company. The Client presently owns a bond portfolio with $1 million invested in zero coupon Treasury bonds that mature in 10 years. (The total par value at maturity is $1.79 million and yield to maturity is about 6%, but that information is not necessary for the mini case.) You have calculated the rate of return on 10-year zero coupon for each scenario.

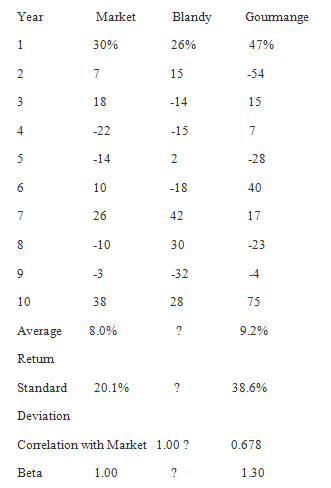

Historical Stock Returns

The Risk Free Rate is 4% and the market risk premium is 5%

Suppose instead that investors? risk aversion increased enough to cause the market risk premium to increase by 3 percentage points. (Assume the risk-free rate remains constant.) What effect would this have on the SML and on returns of high- and low-risk securities?

Scenario Worst Case Poor Case Most Likely Good Case Best Case Probability of Scenario 0.10 0.20 0.40 0.20 0.10 1.00 Return on a 10-year Zero Coupon During the next year -14% -4% 6% 16% 26% Year 1 2 3 4 5 6 7 8 9 10 Market Beta 30% 7 18 -22 -14 10 26 -10 -3 38 8.0% 20.1% Blandy 1.00 26% 15 -14 -15 2 -18 42 Average Retum Standard Deviation Correlation with Market 1.00 ? 30 -32 28 ? ? Gourmange 47% -54 15 7 -28 40 17 -23 -4 75 9.2% 38.6% 0.678 1.30

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

When investors risk aversions increased than SML mo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started