Question

Based on past experience, a company has developed the following budget formula for estimating its shipping expenses. The company's shipments average 18 lbs. per shipment:

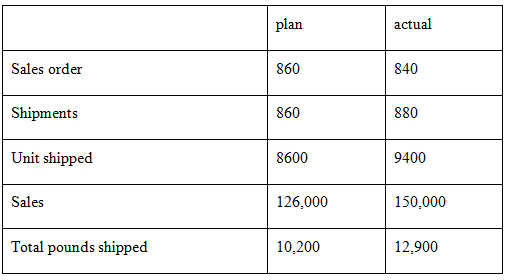

Based on past experience, a company has developed the following budget formula for estimating its shipping expenses. The company's shipments average 18 lbs. per shipment: Shipping costs = $22,000 + ($0.50 ? lbs. shipped). The planned activity and actual activity regarding orders and shipments for the current month are given in the following schedule:

The actual shipping costs for the month amounted to $27,450. The appropriate monthly flexible budget allowance for shipping costs for the purpose of performance evaluation would be:

a) 27,450

b) 33,900

c) 28,450

d) 32,550

Sales order Shipments Unit shipped Sales Total pounds shipped plan 860 860 8600 126,000 10,200 actual 840 880 9400 150,000 12,900

Step by Step Solution

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Appropriate monthly flexible budget allowa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Advanced Accounting

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

5th edition

978-0077924379, 77924371, 978-0078025396, 78025397, 978-0077425654, 77425650, 978-0077667061

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App