Question

Clear Panes, Inc. is a manufacturer of energy efficient residential windows. The organization is a leader in the industry and is well known for the

Clear Panes, Inc. is a manufacturer of energy efficient residential windows. The organization is a leader in the industry and is well known for the craftsmanship of their products. Clear Panes, Inc. started as a family owned and private business in 1947. However, the organization quickly expanded in 1950 as it became the sole supplier for a number of contractors that constructed pre-fabricated homes for new housing developments. Over the next several decades, the company developed new manufacturing techniques that allowed for the production of innovative and durable windows to be used in a variety of homes. In the last five years, the company has developed products that exceed governmental standards for superior energy efficiency. They are also exploring opportunities to implement green practices in their production facilities.

These are the last three questions that you must address:

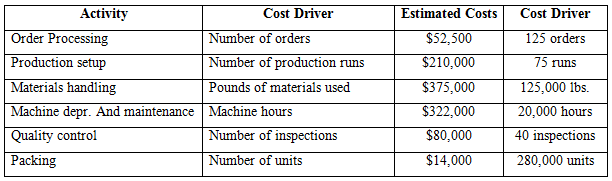

Clear Panes, Inc. manufactures and distributes three tiers of products. A recommendation was presented to switch to an ABC system. The cost break down for the first month of the year consists of the following:

There is an additional estimate of 50,000 direct labor hours at a rate of $14 per hour.

Assume the following activity took place:

1) Compute the production costs for each product in the first month of the year using direct labor hours as the allocation base. Compute the production costs for each product in the first month of the year using machine hours as the allocation base.

2) Compute the production costs for each product in the first month of the year using activity-based costing.

3) Should this company accept the recommendation to switch to an ABC system? Why or why not? Include the advantages and disadvantages of an ABC system.

Activity Cost Driver Number of orders Number of production runs Pounds of materials used Order Processing Production setup Materials handling Machine depr. And maintenance Machine hours Quality control Packing Number of inspections Number of units Estimated Costs $52,500 $210,000 $375,000 $322,000 $80,000 $14,000 Cost Driver 125 orders 75 runs 125,000 lbs. 20,000 hours 40 inspections 280,000 units Number of units produced Direct material costs Direct labor hours Number of orders Number of production runs Pounds of material Machine hours Number of inspections Number of units shipped Basic 20,000 $20,800 500 6 2 8,000 1,200 3 18,000 Intermediate 8,000 $13,000 1,000 4 2 3,200 300 3 7,500 Premier 3,000 $8,000 2,000 3 3 1,500 200 2 2,500

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Labor Hours Allocation as the base Basic Intermediate Premier Direct Material Cost 104 2080020000 163 130008000 267 80003000 Direct Labor Hours per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6094ca286e1ca_25243.pdf

180 KBs PDF File

6094ca286e1ca_25243.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started