Question

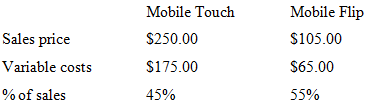

Hughes Inc. sells two different types of mobile phones. The following data is available for these two products. The company has total annual fixed costs

Hughes Inc. sells two different types of mobile phones. The following data is available for these two products.

The company has total annual fixed costs of $1,115,000 per year. The tax rate for the company is 30%

Requirements:

A. Calculate the number of total phones that Hughes Inc. needs to sell in order to break-even.

B. Calculate the number of each phone that Hughes Inc. needs to sell in order to break-even.

C. Calculate the number of each phone that Hughes Inc. needs to sell in order to earn a pre-tax net operating income of $200,000

D. Calculate the number of total phones that Hughes Inc. needs to sell in order to earn a after-tax net operating income of $175,000

Sales price Variable costs % of sales Mobile Touch $250.00 $175.00 45% Mobile Flip $105.00 $65.00 55%

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Mobile Touch Mobile Flip Sales Price 250 105 Variable 175 65 Contribution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6091e6aae7788_22646.pdf

180 KBs PDF File

6091e6aae7788_22646.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started