Question

NIAN Company is a price-taker. It produces large spools of electrical wire in a highly competitive market, so it practices target pricing. The current market

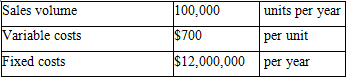

NIAN Company is a price-taker. It produces large spools of electrical wire in a highly competitive market, so it practices target pricing. The current market price of the electric wire is $800 per unit. The company has $3,000,000 in assets and its shareholders expect a return of 6% on assets. The company provides the following information:

If fixed costs cannot be reduced, how much reduction in variable costs will be needed to achieve the profit target?

Sales volume Variable costs Fixed costs 100,000 $700 $12,000,000 units per year per unit per year

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Variable costs 700 per unit 70000000 Fixed costs 120...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics

Authors: Campbell R. McConnell, Stanley L. Brue, Sean M. Flynn

18th edition

978-0077413798, 0-07-336880-6, 77413792, 978-0-07-33688, 978-0073375694

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App