Question

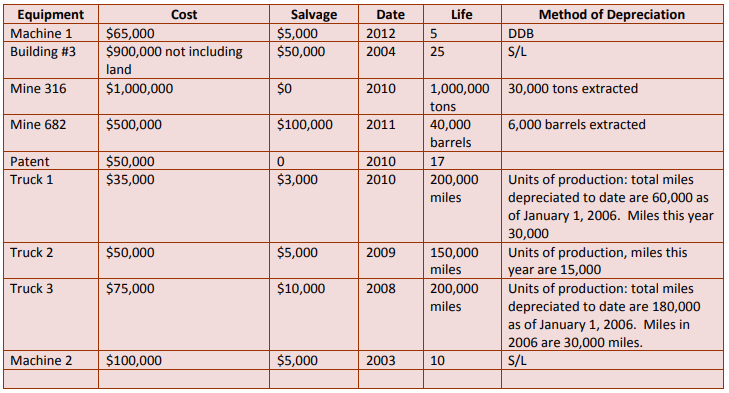

On December 31, 2013, the Mallory Corporation had the following activity in its fixed assets record. Assume all assets were purchased on January 1. Required

On December 31, 2013, the Mallory Corporation had the following activity in its fixed assets record. Assume all assets were purchased on January 1.

Required

? Compute the depletion, amortization, and depreciation expense on December 31, 2013 for each asset listed above.

? Record the entries for the assets above

? Suppose that we sold machine 2 for $50,000, record the entry

? Suppose that the building life increased from 25 years to 30 years, revise the depreciation and prepare the entry.

? Suppose that the corporation spent $20,000 in 2013 to defend the patent. Record the entry.

Equipment Machine 1 Building #3 Mine 316 Mine 682 Patent Truck 1 Truck 2 Truck 3 Machine 2 $65,000 $900,000 not including land $1,000,000 $500,000 $50,000 $35,000 $50,000 $75,000 Cost $100,000 Salvage $5,000 $50,000 $0 $100,000 0 $3,000 $5,000 $10,000 $5,000 Date 2012 2004 2010 2011 2010 2010 2009 2008 2003 5 25 Life 1,000,000 tons 40,000 barrels 17 200,000 miles 150,000 miles 200,000 miles 10 Method of Depreciation DDB S/L 30,000 tons extracted 6,000 barrels extracted Units of production: total miles depreciated to date are 60,000 as of January 1, 2006. Miles this year 30,000 Units of production, miles this year are 15,000 Units of production: total miles depreciated to date are 180,000 as of January 1, 2006. Miles in 2006 are 30,000 miles. S/L

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

MACHINE 1 YEAR NET BOOK VALUE RATE DEPRECIATION BOOK VALU AT END 2012 65000 40 26000 39000 2013 3900...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started