Question: Prepare a cash flow statement based on the info provided on the income statement. GROSS REVENUES Beer Liquor Food Soda/Snacks Arcade Parties Whirlyball TOTAL GROSS

Prepare a cash flow statement based on the info provided on the income statement.

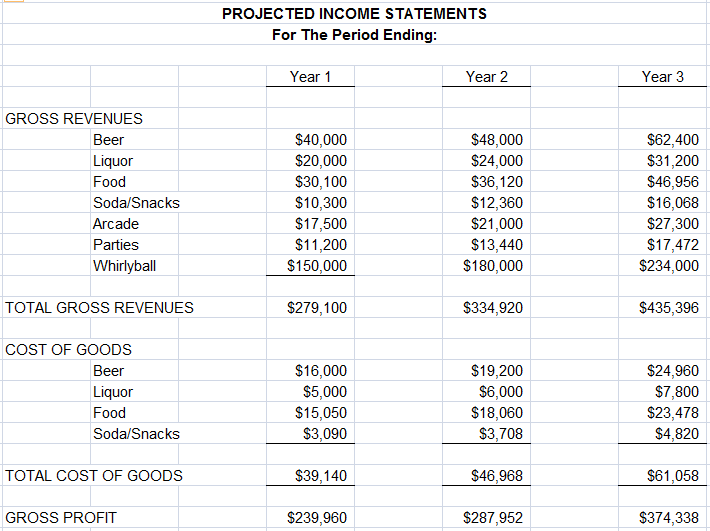

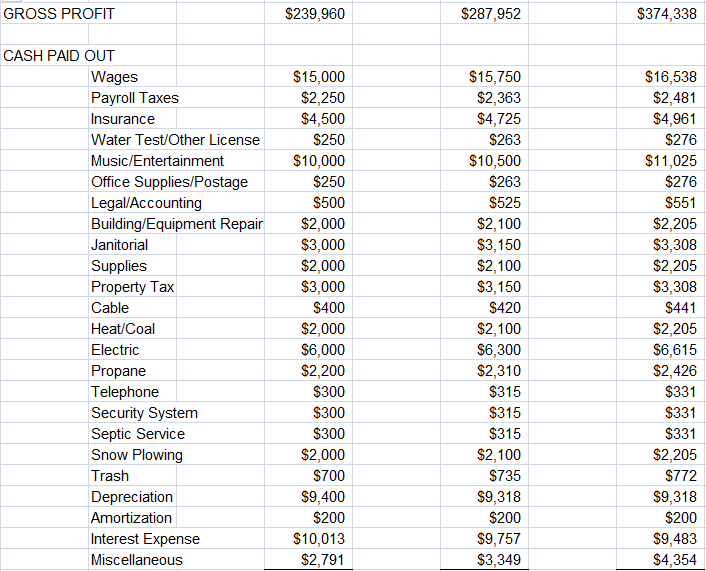

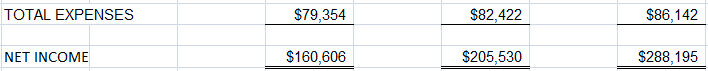

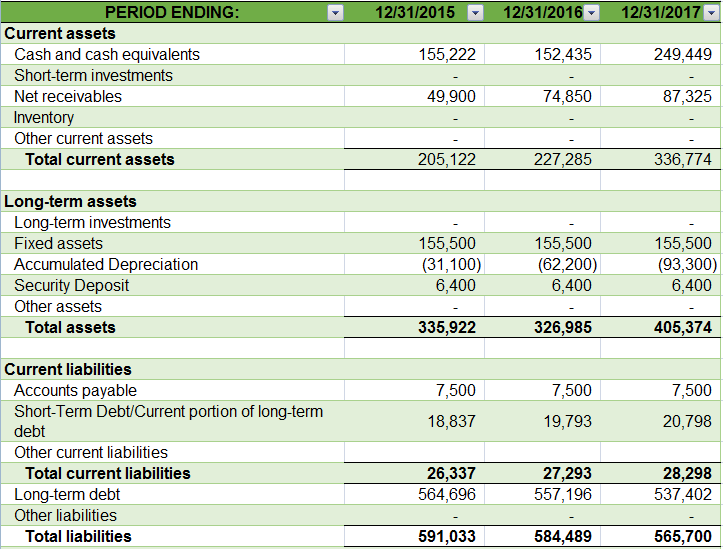

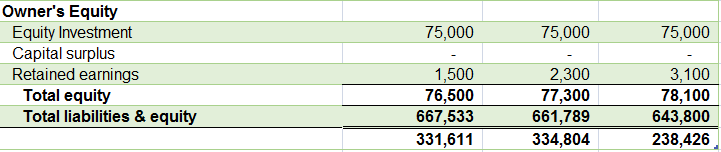

GROSS REVENUES Beer Liquor Food Soda/Snacks Arcade Parties Whirlyball TOTAL GROSS REVENUES COST OF GOODS Beer Liquor Food Soda/Snacks TOTAL COST OF GOODS GROSS PROFIT PROJECTED INCOME STATEMENTS For The Period Ending: Year 1 $40,000 $20,000 $30,100 $10,300 $17,500 $11,200 $150,000 $279,100 $16,000 $5,000 $15,050 $3,090 $39,140 $239,960 Year 2 $48,000 $24,000 $36,120 $12,360 $21,000 $13,440 $180,000 $334,920 $19,200 $6,000 $18,060 $3,708 $46,968 $287,952 Year 3 $62,400 $31,200 $46,956 $16,068 $27,300 $17,472 $234,000 $435,396 $24,960 $7,800 $23,478 $4,820 $61,058 $374,338 GROSS PROFIT CASH PAID OUT Wages Payroll Taxes Insurance Water Test/Other License Music/Entertainment Office Supplies/Postage Legal/Accounting Building/Equipment Repair Janitorial Supplies Property Tax Cable Heat/Coal Electric Propane Telephone Security System Septic Service Snow Plowing Trash Depreciation Amortization Interest Expense Miscellaneous $239,960 $15,000 $2,250 $4,500 $250 $10,000 $250 $500 $2,000 $3,000 $2,000 $3,000 $400 $2,000 $6,000 $2,200 $300 $300 $300 $2,000 $700 $9,400 $200 $10,013 $2,791 $287,952 $15,750 $2,363 $4,725 $263 $10,500 $263 $525 $2,100 $3,150 $2,100 $3,150 $420 $2,100 $6,300 $2,310 $315 $315 $315 $2,100 $735 $9,318 $200 $9,757 $3,349 $374,338 $16,538 $2,481 $4,961 $276 $11,025 $276 $551 $2,205 $3,308 $2,205 $3,308 $441 $2,205 $6,615 $2,426 $331 $331 $331 $2,205 $772 $9,318 $200 $9,483 $4,354 TOTAL EXPENSES NET INCOME $79,354 $160,606 $82,422 $205,530 $86,142 $288,195 PERIOD ENDING: Current assets Cash and cash equivalents Short-term investments Net receivables Inventory Other current assets Total current assets Long-term assets Long-term investments Fixed assets Accumulated Depreciation Security Deposit Other assets Total assets Current liabilities Accounts payable Short-Term Debt/Current portion of long-term debt Other current liabilities Total current liabilities Long-term debt Other liabilities Total liabilities 12/31/2015 155,222 49,900 205,122 155,500 (31,100) 6,400 335,922 7,500 18,837 26,337 564,696 591,033 12/31/2016 12/31/2017 152,435 74,850 227,285 155,500 (62,200) 6,400 326,985 7,500 19,793 27,293 557,196 584,489 249,449 87,325 336,774 155,500 (93,300) 6,400 405,374 7,500 20,798 28,298 537,402 565,700 Owner's Equity Equity Investment Capital surplus Retained earnings Total equity Total liabilities & equity 75,000 1,500 76,500 667,533 331,611 75,000 2,300 77,300 661,789 334,804 75,000 3,100 78,100 643,800 238,426

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

To prepare a cash flow statement well use a simplified approach focusing on operating investing and ... View full answer

Get step-by-step solutions from verified subject matter experts