Question

Redbird Corporation was created six years ago through contributions from Megan ($900,000) and Paul ($100,000). In a transaction qualifying as a reorganization, Redbird exchanges all

Redbird Corporation was created six years ago through contributions from Megan ($900,000) and Paul ($100,000). In a transaction qualifying as a reorganization, Redbird exchanges all of its assets currently valued at $1,500,000 (basis of $700,000) for King Corporation stock valued at $1,400,000 plus $100,000 in King bonds. Redbird distributes the King stock and bonds proportionately to Paul and Megan in exchange for their stock in Redbird. Redbird's current and accumulated E & P before the reorganization amounts to $60,000. If an amount is zero, enter "0".

a. Complete the computations below for Megan and Paul regarding this transaction.

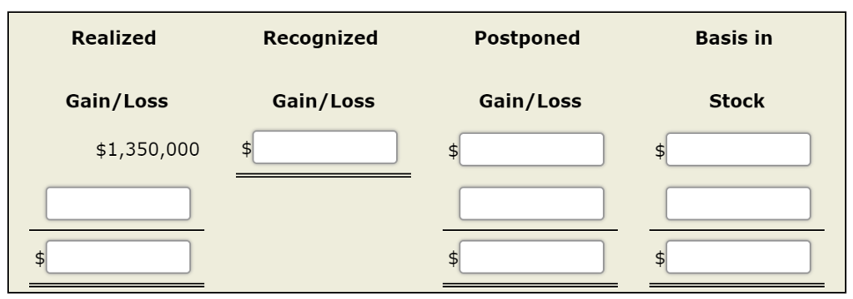

Megan:

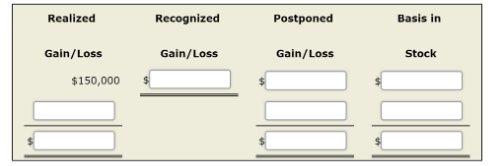

Paul:

The character of Megan and Paul?s gain is__________.

b. Complete the statement below regarding how Redbird and king should treat this transaction, including King?s basis in the assets it receives from Redbird.

Redbird recognizes $ gain or loss on the reorganization. King?s basis in the Redbird assets is ___________basis of.

tA Realized Gain/Loss $1,350,000 $ Recognized Gain/Loss LA Postponed Gain/Loss Basis in Stock Realized Gain/Loss $150,000 Recognized Gain/Loss Postponed Gain/Loss Basis in Stock

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Realized Recognised Postponed Basis 1350000 945000 45000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609368f40fb1f_23782.pdf

180 KBs PDF File

609368f40fb1f_23782.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started