Terry Marks is a well-known architect. He wants to start his own business and convinces Rob Norris, his cousin and a civil engineer, to contribute

Terry Marks is a well-known architect. He wants to start his own business and convinces Rob Norris, his cousin and a civil engineer, to contribute capital. Together, they form a partnership to design and build commercial real estate. On January 1, 2011, Norris invests a building worth $126,000 and equipment valued at $132,000 as well as $52,000 in cash. Although Marks makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances.

To entice Norris to join this partnership, Marks draws up the following profit and loss agreement. Norris will be credited annually with interest equal to 10 percent of the beginning capital balance for the year.

Norris will also have added to his capital account 20 percent of partnership income each year (without regard for the preceding interest figure) or $7,000, whichever is larger. All remaining income is credited to Marks.

Neither partner is allowed to withdraw funds from the partnership during 2011. Thereafter, each can draw $7,000 annually or 10 percent of the beginning capital balance for the year, whichever is larger.

The partnership reported a net loss of $12,000 during the first year of its operation. On January 1, 2012, Alice Dunn becomes a third partner in this business by contributing $60,000 cash to the partnership. Dunn receives a 25 percent share of the business's capital. The profit and loss agreement is altered as follows:

Norris is still entitled to (1) interest on his beginning capital balance as well as (2) the share of partnership income just specified.

Any remaining profit or loss will be split on a 6:4 basis between Marks and Dunn, respectively.

Partnership income for 2012 is reported as $96,000. Each partner withdraws the full amount that is allowed.

On January 1, 2013, Dunn becomes ill and sells her interest in the partnership (with the consent of the other two partners) to Judy Postner. Postner pays $215,000 directly to Dunn. Net income for 2013 is $95,000 with the partners again taking their full drawing allowance.

On January 1, 2014, Postner withdraws from the business for personal reasons. The articles of partnership state that any partner may leave the partnership at any time and is entitled to receive cash in an amount equal to the recorded capital balance at that time plus 10 percent.

As luck would have it, also on January 1, 2014, two young partners are admitted from the staff, each at 50% of Postner?s departing capital withdrawal. James Rogers and Savannah (her full name) each contribute cash in exchange for their capital interest.

a) Prepare journal entries to record the preceding transactions on the assumption that the bonus (or no revaluation) method is used. Drawings need not be recorded, although the balances should be included in the closing entries.

b) Prepare journal entries to record the previous transactions on the assumption that the goodwill (or revaluation) method is used. Drawings need not be recorded, although the balances should be included in the closing entries.

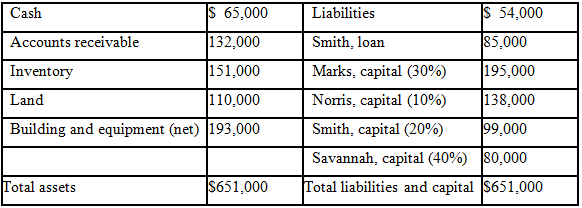

c) The partnership of Marks, Norris, Smith, and Savannah has now operated for several years. Last year, Marks and Norris reduced their interests in the business and the partnership agreement was amended to reapportion capital interests. Since then, recent market declines have caused several partners to undergo personal financial problems. As a result, the partners have decided to terminate operations and liquidate the business. The following balance sheet is drawn up as a guideline for this process:

When the liquidation commenced, expenses of $20,000 were anticipated as being necessary to dispose of all property.Prepare a predistribution plan for the partnership.

d) The following transactions transpire during the liquidation of the Marks, Norris, Smith, and Savannah partnership:

? Collected 90 percent of the total accounts receivable with the rest judged to be uncollectible.

? Sold the land, building, and equipment for $175,000.

? Made safe capital distributions.

? Learned that Savannah, who has become personally insolvent, will make no further contributions.

? Paid all liabilities.

? Sold all inventory for $96,000.

? Made safe capital distributions again.

? Paid liquidation expenses of $14,000.

? Made final cash disbursements to the partners based on the assumption that all partners other than Savannah are personally solvent.

Prepare journal entries to record these liquidation transactions.

Cash $ 65,000 Accounts receivable 132,000 Inventory 151,000 Land 110,000 Building and equipment (net) 193,000 Total assets $651,000 Liabilities Smith, loan Marks, capital (30%) Norris, capital (10%) Smith, capital (20%) Savannah, capital (40%) Total liabilities and capital $ 54,000 85,000 195,000 138,000 99,000 80,000 $651,000

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a On the first day both partners share equal amount in the beginning Beginning balance12600013200052000215500 Prepare an official journal entry Date Description Debit Credit 112011 Building 126000 Equ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started