Question

The following information relates to David and Mary Hopkins for tax year 2014. Use this information to provide answers to the questions. You will submit

The following information relates to David and Mary Hopkins for tax year 2014. Use this information to provide answers to the questions. You will submit the ?answer page? only.

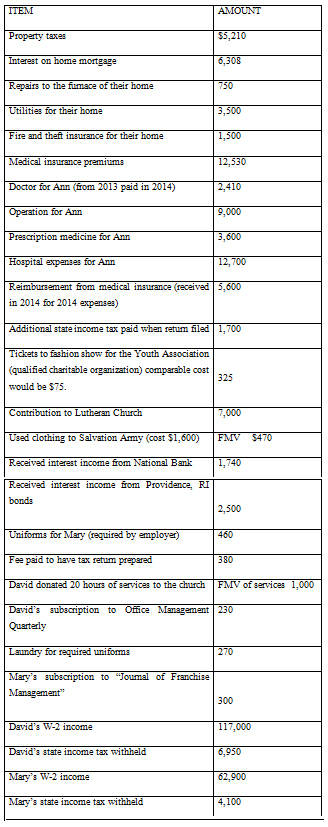

David (50) and Mary (49) are married and file a joint tax return. David is the office manager for an accounting firm and Mary is the manager of a restaurant in their town. David and Mary have 3 children: Kim (10), Karen (17) and Karl (25) who lived with them all year. Kim is in elementary school. Karen is a high school senior. Karl is in graduate school and commutes to classes. Karen earned $4,300 as a waitress and Karl earned $3,100 as a sailing instructor during the summer and $2,500 as a graduate research assistant during the regular school year. David and Mary furnish 60% of the support of David?s aunt, Ann, who lived alone in her own residence during the year. Ann provided the rest of her support from her non taxable Social Security benefits and $4,000 of interest from a City of Grand Rapids, MI bond. Ann passed away in April and David was the beneficiary on her life insurance policy and received $100,000 in life insurance proceeds on May 2nd. The Hopkins had the following income and expenses during the 2014 tax year:

|

|

ITEM Property taxes Interest on home mortgage Repairs to the fumace of their home Utilities for their home Fire and theft insurance for their home Medical insurance premiums Tickets to fashion show for the Youth Association (qualified charitable organization) comparable cost would be $75. Contribution to Lutheran Church Used clothing to Salvation Army (cost $1,600) Received interest income from National Bank Doctor for Ann (from 2013 paid in 2014) Operation for Ann 9,000 Prescription medicine for Ann 3,600 Hospital expenses for Ann 12,700 Reimbursement from medical insurance (received 5,600 in 2014 for 2014 expenses) Additional state income tax paid when return filed | 1,700 Received interest income from Providence, RI bonds Uniforms for Mary (required by employer) Fee paid to have tax retum prepared David donated 20 hours of services to the church David's W-2 income AMOUNT $5,210 6,308 David's state income tax withheld 750 Mary's W-2 income Mary's state income tax withheld 3,500 1,500 12,530 2,410 325 7,000 FMV $470 1,740 2,500 460 David's subscription to Office Management 230 Quarterly Laundry for required uniforms Mary's subscription to "Joumal of Franchise Management" 380 FMV of services 1,000 270 300 117,000 6,950 62,900 4,100

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Sheet Number of exemptions allowed for 2014 for the Hopkins 7 Total Gross I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started