Question

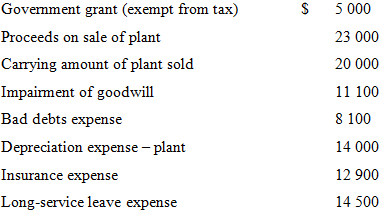

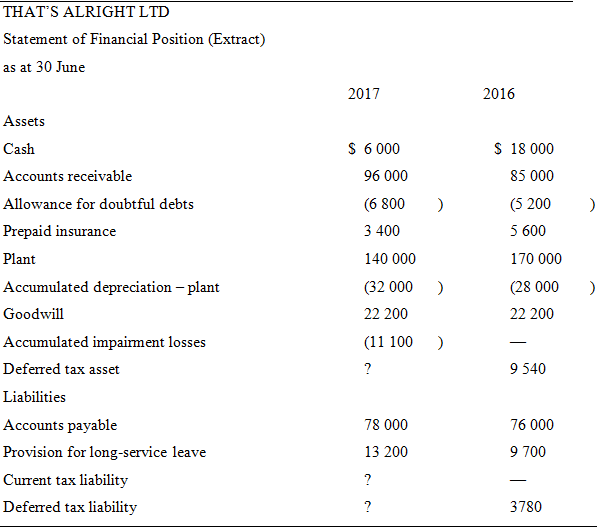

The statements of financial position of that?s Alright Ltd at 30 June 2017 and 30 June 2016 includes the following assets and liabilities: Additional information

The statements of financial position of that?s Alright Ltd at 30 June 2017 and 30 June 2016 includes the following assets and liabilities:

Additional information

? For tax purposes the carrying amount of plant sold was $15 000.

? The tax deduction for plant depreciation was $20 250. The accumulated depreciation on plant for tax purposes at 30 June 2017 is $40 250 (2016: $35 000).

? In the year ended 30 June 2016, the company recorded a tax loss. At 1 July 2016 carry forward tax losses amounted to $16 900. The company recognized a deferred tax asset in respect of these tax losses at 30 June 2016.

? Tax losses carried forward must be offset against any exempt income before being used to reduce taxable income.

? The company does not set off deferred tax liabilities and assets and the corporate tax rate is 30%.

A. Prepare the current tax worksheet for the year ended 30 June 2017 and the applicable tax entries.

B. Discuss the factors the company should have considered before recognizing a deferred tax asset with respect to the tax loss incurred in the year ended 30 June 2016?

C. Prepare the deferred tax worksheet as at 30 June 2017 and the applicable tax entries.

Government grant (exempt from tax) Proceeds on sale of plant Carrying amount of plant sold Impairment of goodwill Bad debts expense Depreciation expense - plant Insurance expense Long-service leave expense SA 5 000 23 000 20 000 11 100 8 100 14 000 12 900 14 500 THAT'S ALRIGHT LTD Statement of Financial Position (Extract) as at 30 June Assets Cash Accounts receivable Allowance for doubtful debts Prepaid insurance Plant Accumulated depreciation - plant Goodwill Accumulated impairment losses Deferred tax asset Liabilities Accounts payable Provision for long-service leave Current tax liability Deferred tax liability 2017 $ 6000 96 000 (6 800 3 400 140 000 (32 000 ) 22 200 (11 100 ? 78 000 13 200 ? ? ) ) 2016 $ 18 000 85 000 (5 200 5 600 170 000 (28 000 22 200 9 540 76 000 9 700 3780 ) )

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

A Current Tax Worksheet For the year ended 30 June 2017 Profit before income tax 22 240 Add Impairment of goodwill nondeductible 11 100 Depreciation e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started