Question: With this case, a comparison is made between three firms in different industries using net profit margin, total asset turnover and current ratio. 1. Apple

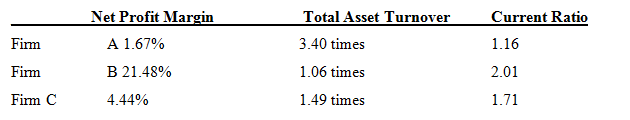

With this case, a comparison is made between three firms in different industries using net profit margin, total asset turnover and current ratio.

1. Apple

1. Apple

Fiscal year 2010 ended September 25, 2010, and consisted of 52 weeks ?Apple, Inc. and its wholly-owned subsidiaries (collectively ?Apple? or the ?Company?) designs, manufactures and markets a range of personal computers, mobile communication and media devices, and portable digital music players, and sells a variety of related software, services, peripherals, networking solutions, and third-party digital content and applications.? 10-K

2. Costco Wholesale Corporation

Fiscal year ended August 29, 2010, and consisted of 52 weeks ?We operate membership warehouses based on the concept that offering our member?s low prices on a limited selection of nationally branded and selected private-label products in a wide range of merchandise categories will produce high sales volumes and rapid inventory turnover.? 10-K

3. Target Corporation

Fiscal year 2010 ended January 29, 2011, and consisted of 52 weeks ?Our Retail Segment includes all of our merchandising operations, including our fully integrated online business. We offer everyday essentials and fashionable, differentiated merchandise at discounted prices.? 10-K

Required

a. Which firm is Firm A? Comment on your reasons.

b. Which firm is Firm B? Comment on your reasons.

c. Which firm is Firm C? Comment on your reasons.

Firm Firm Firm C Net Profit Margin A 1.67% B 21.48% 4.44% Total Asset Turnover 3.40 times 1.06 times 1.49 times Current Ratio 1.16 2.01 1.71

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

To determine which firm corresponds to Firm A B or C we need to consider the nature of each business and how these financial metrics typically reflect ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

60826d2eac5cd_12260.pdf

180 KBs PDF File

60826d2eac5cd_12260.docx

120 KBs Word File