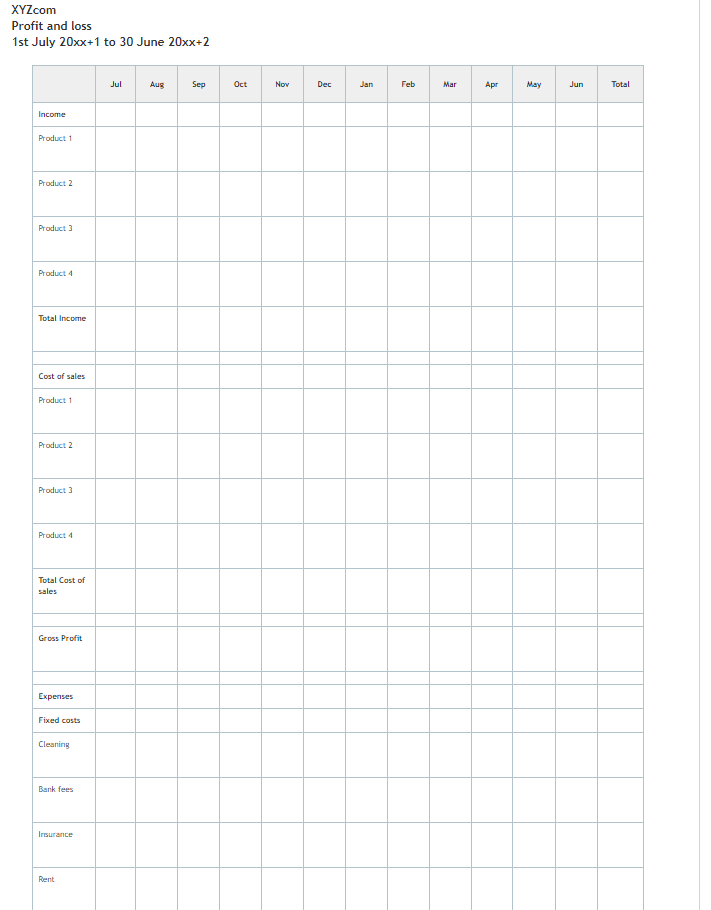

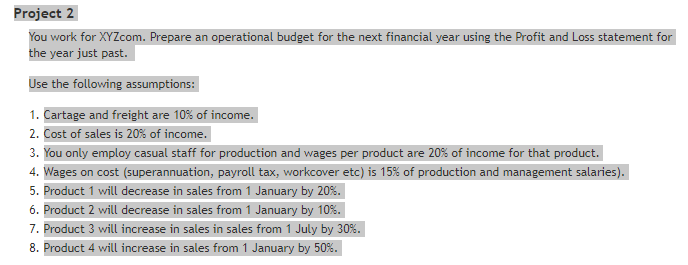

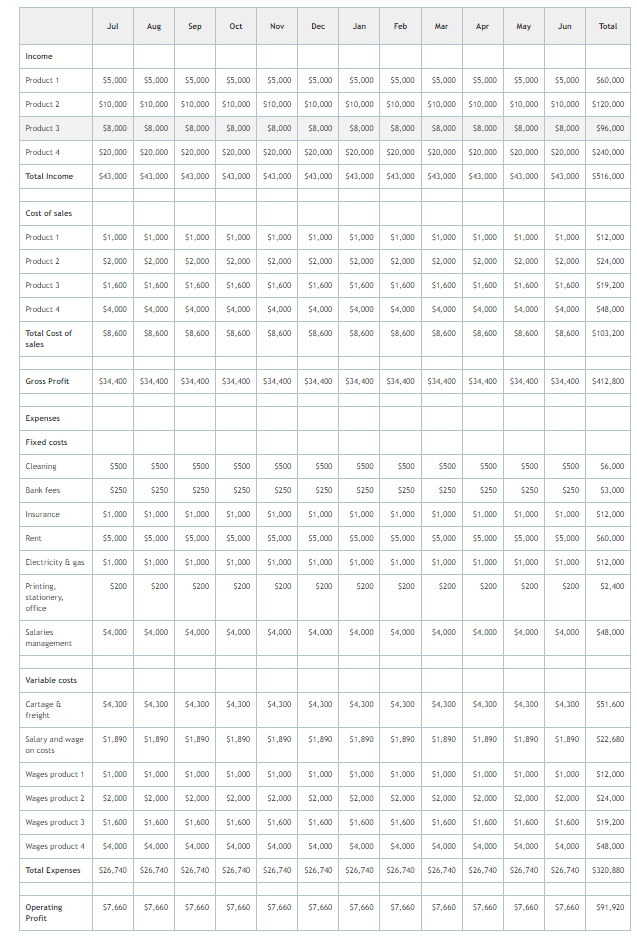

XYZcom Profit and loss 1st July 20xx+1 to 30 June 20xx+2 Jul Aus Sep Oct Now Dec Jan Feb Mar Ap May Jun Total Income Product 1 Product 2 Product 3 Product 4 Total Income Cost of sales Product 1 Product 2 Product 3 Product 4 Total Cost of sales Gross Profit Expenses Fixed costs Cleaning Bank fees Insurance RentProject 2 You work for XYZcom. Prepare an operational budget for the next financial year using the Profit and Loss statement for the year just past. Use the following assumptions: 1. Cartage and freight are 10% of income. 2. Cost of sales is 20% of income. 3. You only employ casual staff for production and wages per product are 20% of income for that product. 4. Wages on cost (superannuateon, payroll tax, workcover etc) is 15* of production and management salaries). 5. Product 1 will decrease in sales from 1 January by 20%. 6. Product 2 will decrease in sales from 1 January by 10%. 7. Product 3 will increase in sales in sales from 1 July by 30%. 8. Product 4 will increase in sales from 1 January by 50%.Jul Au Sep Oct Nov Dec Jan Feb Mar AD May Jun Total Income Product 1 $5,000 $5.000 $5.000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5.000 95.000 $5.000 560,000 Product 2 $10,000 $10.000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $120,000 Product ] $8,000 58.000 58,DOC 58,000 58,00 $8,000 $8,000 58.000 58.000 $96,000 Product 4 $20.000 $20.000 520 000 520,000 520,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20 000 $240,000 Total Income $43,000 $43,000 $43.000 $43,000 543,000 $43,000 $43,000 $43,000 $43,000 $43,000 $43,000 $43.000 $516,000 Cost of sales Product 1 $1,000 $1,000 $1 000 $1 000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $12,000 Product 2 52,000 52.000 $2.000 $2 00 $2,000 $2,000 $2,000 $2,00 $2,000 $2,000 52,000 52,000 $24,000 Product 3 $1.600 $1.600 $1 600 $1.600 $1,600 $1,600 $1,600 $1,600 $1,600 $1.600 $1.600 $1 600 $19,200 Product 4 $4.000 $4.000 $4.000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4.000 $4.000 $4 000 548,000 Total Cost of $8,600 $8,600 58 600 58,600 $8,600 58,600 58,600 $8,600 58,600 58.600 58.600 58 600 $103,200 sales Gross Profit 534, 400 $34,400 534.400 $34, 400 $34,400 $34, 400 $34, 400 $34, 400 $34, 400 $34. 400 $34, 400 534.400 $412,800 Expenses Fixed costs Cleaning 5500 $500 $500 $500 $500 5500 $500 $500 $500 $500 $500 $500 56,000 Bank fees $250 $250 $250 $250 $250 $250 $250 5250 5250 $250 $250 $250 $3,000 Insurance $1,000 $1,000 $1.000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1.000 $1,000 $1 000 $12,000 Rent $5.000 $5 00 $5 000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 55,000 $60,000 Electricity a gas $1.000 $1,000 $1 000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1.000 $1,000 $1 000 $12,000 Printing. 5200 $200 $200 $200 $200 $200 $200 5200 5200 $200 $200 $200 $2, 400 stationery, office Salaries $4,000 $4.000 $4.000 $4.000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 54.000 $48,000 management Variable costs Cartage a $4,300 $4,300 $4,300 $4,300 $4,300 54,300 54,300 $4,300 54,300 $4,300 $4,300 54.300 $51,600 freight Salary and wage $1.890 $1,890 $1 890 $1 890 $1,890 $1,890 $1,890 $1,890 $1,890 $1,890 $1,890 $1 890 $22,680 on costs Wages product 1 $1.000 $1,000 $1 000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1 000 $12,000 Wages product 2 52,000 52.000 52,000 $2,000 $2,000 $2,000 $2,00 $2,000 $2,000 52,000 52,000 $2.000 $24,000 Wages product 3 $1.600 $1.600 51 600 $1.600 $1,600 $1,600 $1,600 $1,600 $1,600 $1.600 $1.600 51 600 $19,200 Wages product 4 $4,000 $4,000 $4.000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 54,000 $48,000 Total Expenses $26.740 526,740 $26 740 526,740 526,740 $26,740 $26,740 $26,740 $26,740 $26,740 526,740 526 740 5320,880 Operating 57.660 $7.660 57 660 57 660 $7,660 $7,660 $7,660 $7,660 57,660 57.660 57.660 57 660 991,920 Profit