Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is March. A Canadian farmers' cooperative that is based in Quebec expects to sell 275,000 bushels of soybeans at the end of July

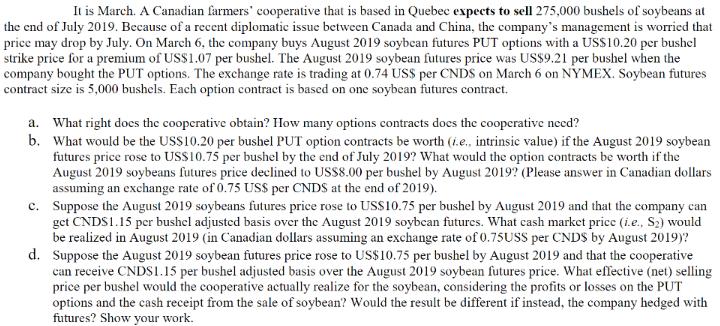

It is March. A Canadian farmers' cooperative that is based in Quebec expects to sell 275,000 bushels of soybeans at the end of July 2019. Because of a recent diplomatic issue between Canada and China, the company's management is worried that price may drop by July. On March 6, the company buys August 2019 soybean futures PUT options with a US$10.20 per bushel strike price for a premium of US$1.07 per bushel. The August 2019 soybean futures price was US$9.21 per bushel when the company bought the PUT options. The exchange rate is trading at 0.74 US$ per CNDS on March 6 on NYMEX. Soybean futures contract size is 5,000 bushels. Each option contract is based on one soybean futures contract. a. What right does the cooperative obtain? How many options contracts does the cooperative need? b. What would be the US$10.20 per bushel PUT option contracts be worth (1.e., intrinsic value) if the August 2019 soybean futures price rose to US$10.75 per bushel by the end of July 2019? What would the option contracts be worth if the August 2019 soybeans futures price declined to US$8.00 per bushel by August 2019? (Please answer in Canadian dollars assuming an exchange rate of 0.75 US$ per CNDS at the end of 2019). c. Suppose the August 2019 soybeans futures price rose to US$10.75 per bushel by August 2019 and that the company can get CNDS1.15 per bushel adjusted basis over the August 2019 soybean futures. What cash market price (i.e., S) would be realized in August 2019 (in Canadian dollars assuming an exchange rate of 0.75USS per CNDS by August 2019)? d. Suppose the August 2019 soybean futures price rose to US$10.75 per bushel by August 2019 and that the cooperative can receive CNDS1.15 per bushel adjusted basis over the August 2019 soybean futures price. What effective (net) selling price per bushel would the cooperative actually realize for the soybean, considering the profits or losses on the PUT options and the cash receipt from the sale of soybean? Would the result be different if instead, the company hedged with futures? Show your work.

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a The cooperative obtains the right to sell soybeans at US1020 per bushel The cooperative need...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started