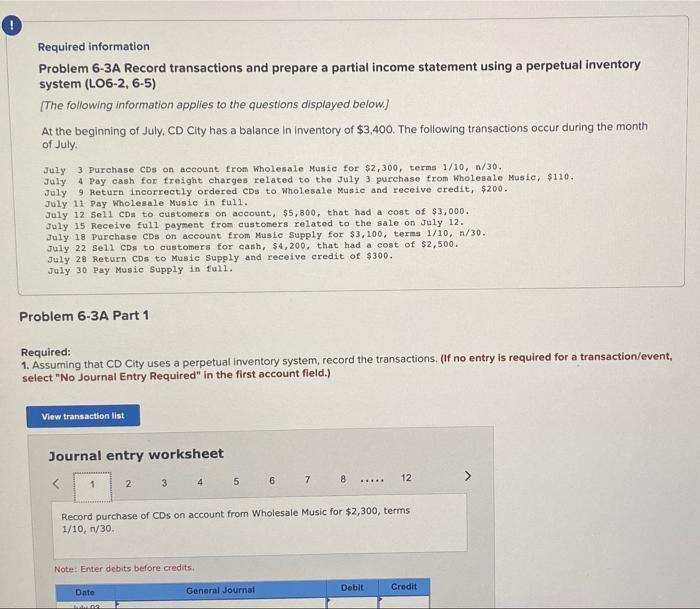

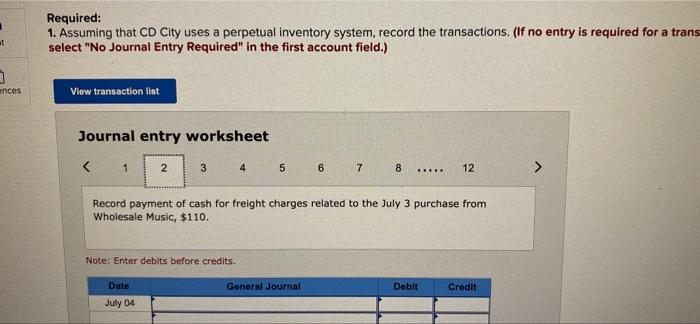

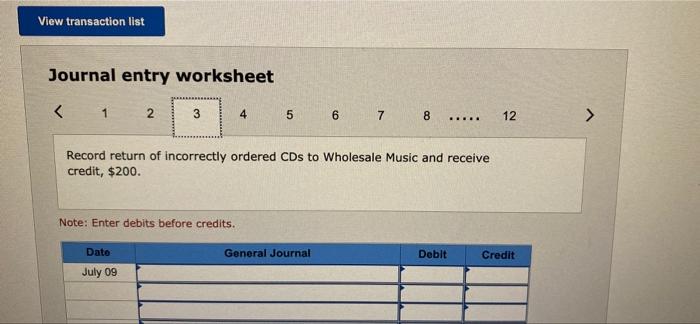

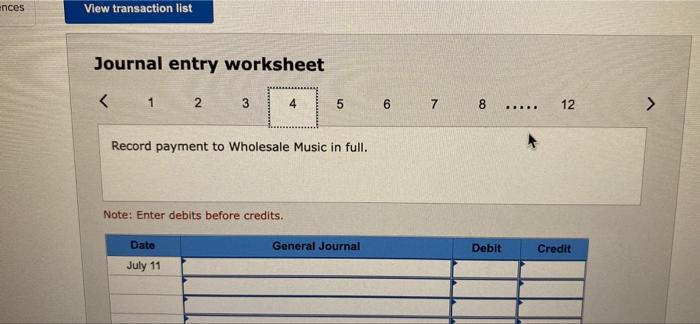

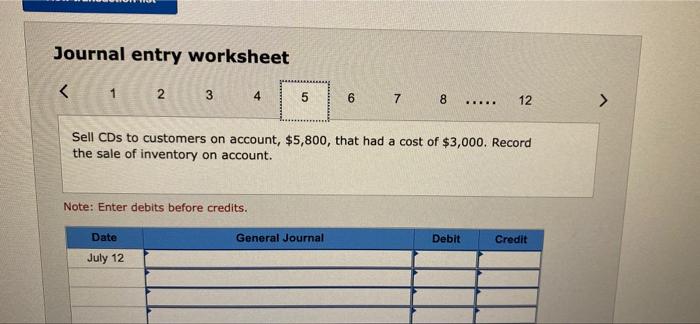

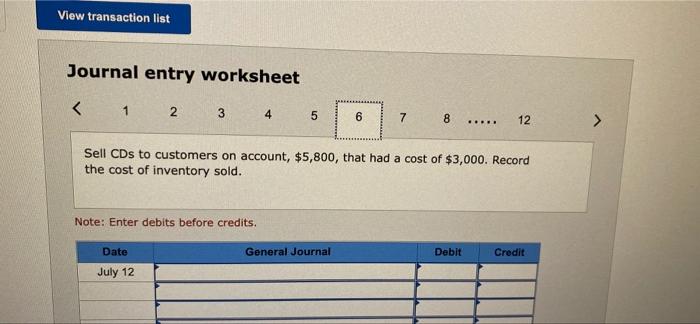

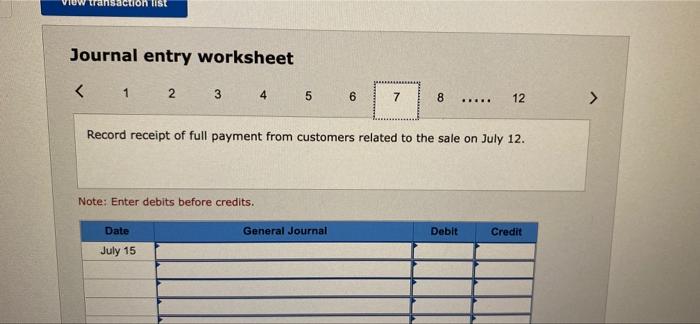

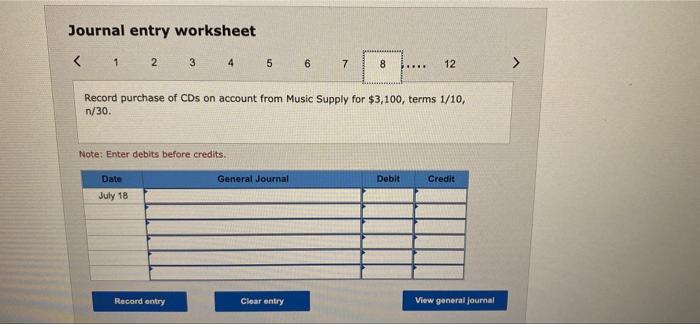

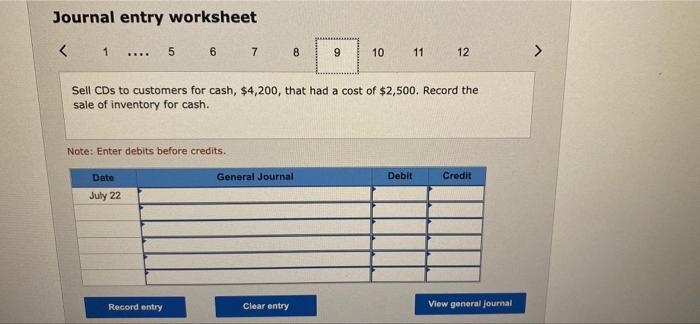

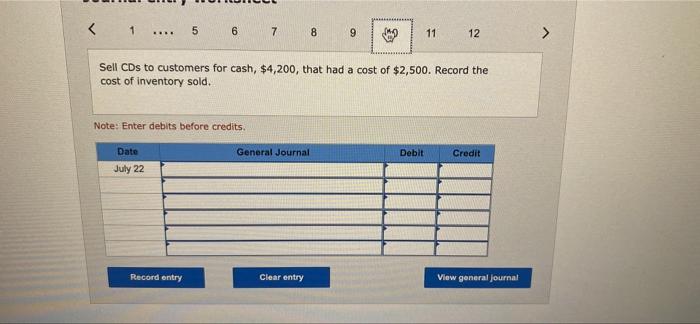

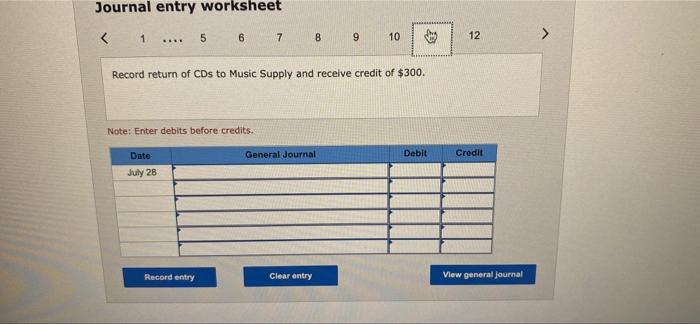

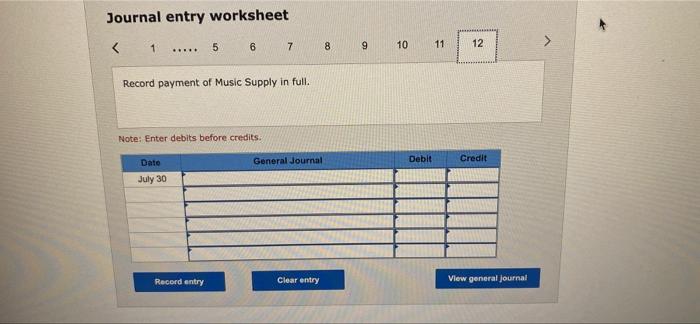

0 Required information Problem 6-3A Record transactions and prepare a partial income statement using a perpetual inventory system (L06-2, 6-5) (The following information applies to the questions displayed below.) At the beginning of July, CD City has a balance in inventory of $3,400. The following transactions occur during the month of July July 3 Purchase CDs on account from Wholesale Music for $2,300, terms 1/10, n/30. July 4 Pay cash for freight charges related to the July 3 purchase from Wholesale Music, $110. July 9 Return incorrectly ordered CDs to Wholesale Music and receive credit, $200. July 11 Pay Wholesale Music in full. July 12 Sell CDs to customers on account, $5,800, that had a cost of $3,000. July 15 Receive full payment from customers related to the sale on July 12. July 18 Purchase CDs on account from Music Supply for $3,100, terms 1/10, n/30. July 22 Sell CDs to customers for cash, $4,200, that had a cost of $2,500. July 28 Return CDs to Music Supply and receive credit of $300. July 30 Pay Music Supply in full. Problem 6-3A Part 1 Required: 1. Assuming that CD City uses a perpetual inventory system, record the transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 3 4 2 5 7 6 8 12 ..... Record purchase of CDs on account from Wholesale Music for $2,300, terms 1/10, 1/30 Note: Enter debits before credits Debit General Journal Date Credit NA Required: 1. Assuming that CD City uses a perpetual inventory system, record the transactions. (If no entry is required for a trans select "No Journal Entry Required" in the first account field.) et ences View transaction list Journal entry worksheet Record payment of cash for freight charges related to the July 3 purchase from Wholesale Music, $110. Note: Enter debits before credits. Date General Journal Debit Credit July 04 View transaction list Journal entry worksheet Record purchase of CDs on account from Music Supply for $3,100, terms 1/10, n/30. Note: Enter debits before credits. General Journal Debit Credit Date July 18 Record entry Clear entry View general Journal Journal entry worksheet