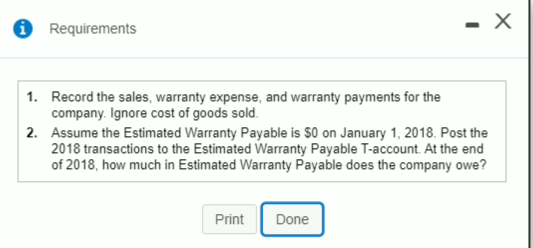

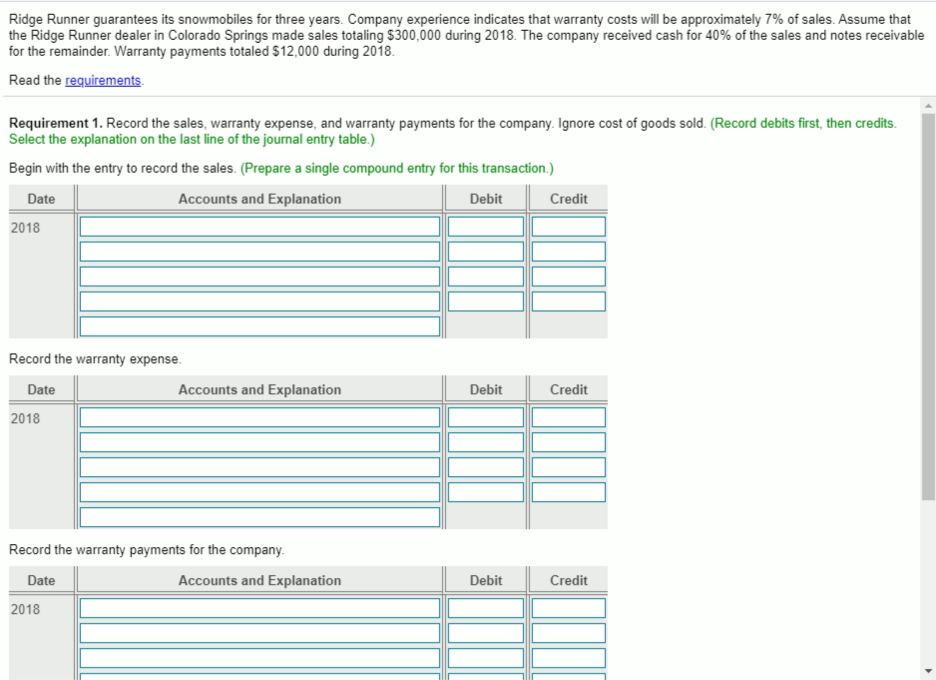

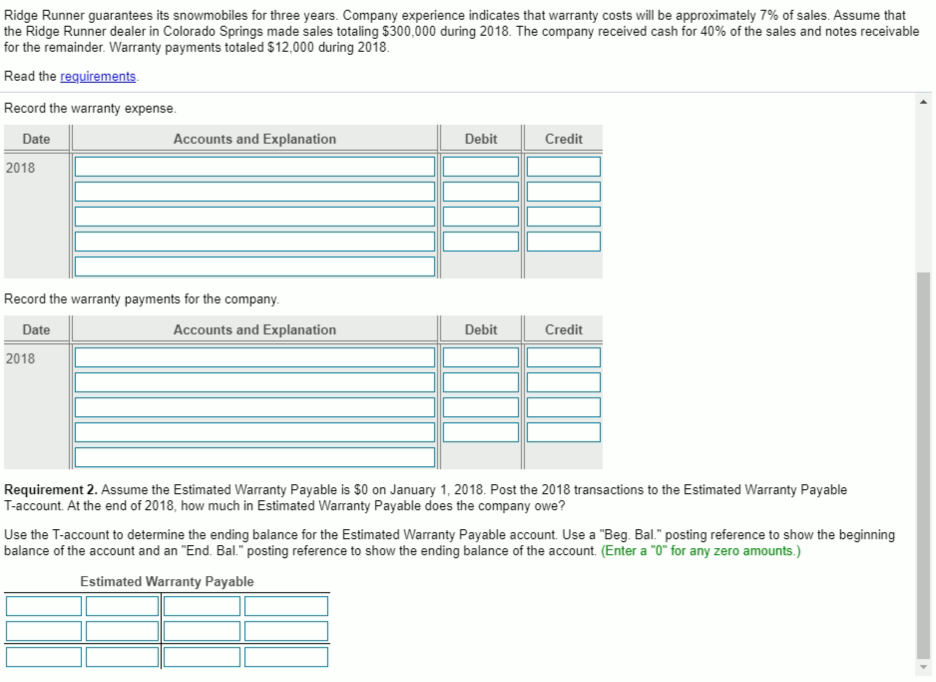

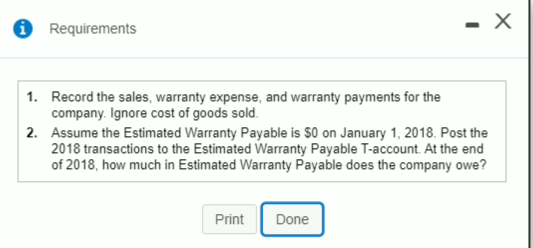

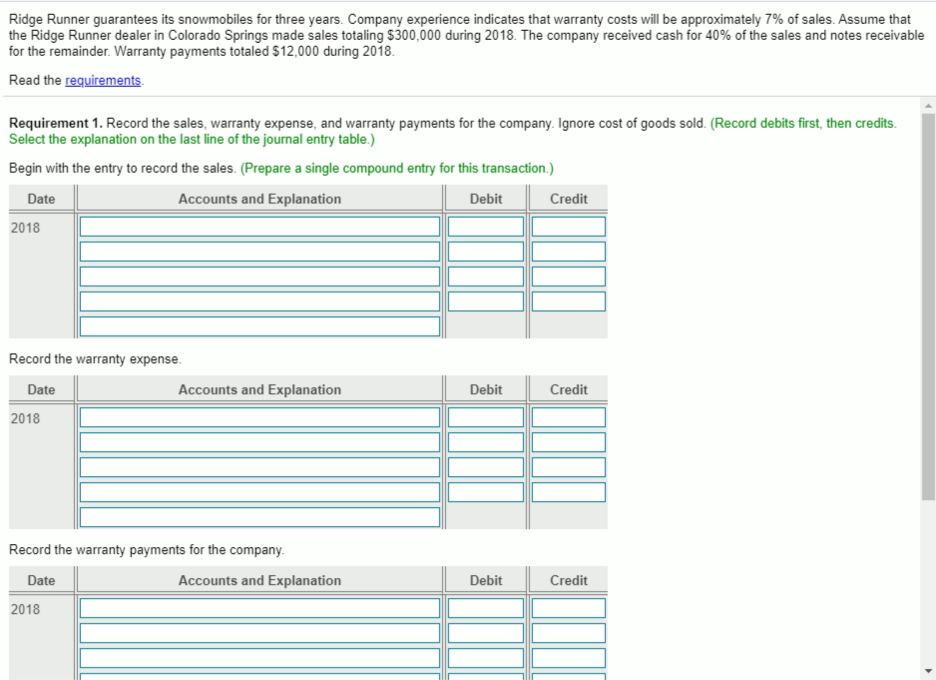

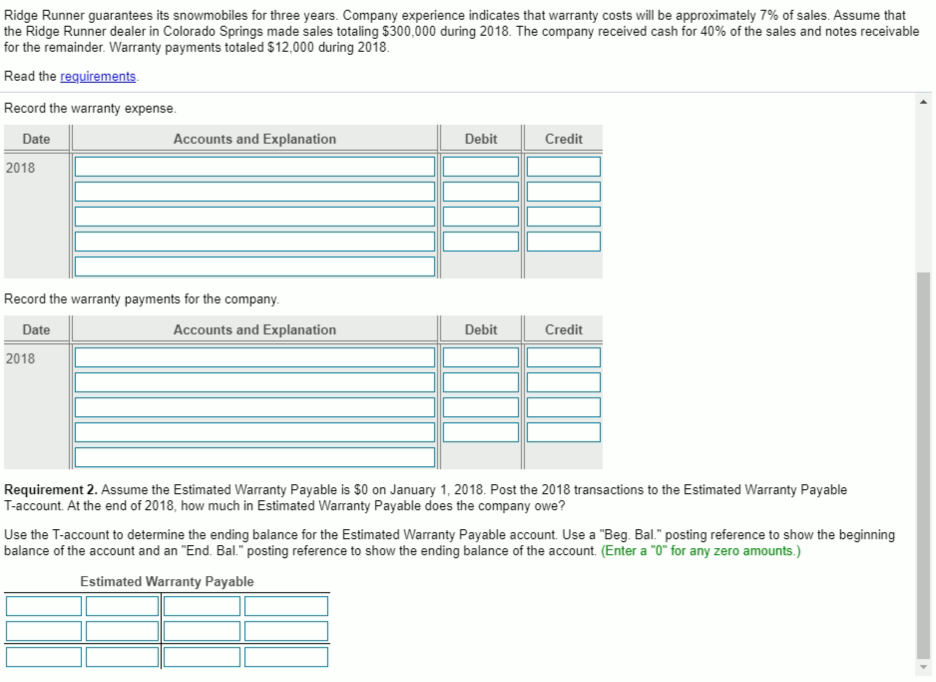

0 Requirements 1. Record the sales, warranty expense, and warranty payments for the company. Ignore cost of goods sold. 2. Assume the Estimated Warranty Payable is $0 on January 1, 2018. Post the 2018 transactions to the Estimated Warranty Payable T-account. At the end of 2018, how much in Estimated Warranty Payable does the company owe? Print Done Ridge Runner guarantees its snowmobiles for three years. Company experience indicates that warranty costs will be approximately 7% of sales. Assume that the Ridge Runner dealer in Colorado Springs made sales totaling $300,000 during 2018. The company received cash for 40% of the sales and notes receivable for the remainder. Warranty payments totaled $12,000 during 2018 Read the requirements Requirement 1. Record the sales, warranty expense, and warranty payments for the company. Ignore cost of goods sold. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin with the entry to record the sales. (Prepare a single compound entry for this transaction.) Date Accounts and Explanation Debit Credit 2018 Record the warranty expense. Date Accounts and Explanation Debit Credit 2018 Record the warranty payments for the company. Date Accounts and Explanation Debit Credit Ridge Runner guarantees its snowmobiles for three years. Company experience indicates that warranty costs will be approximately 7% of sales. Assume that the Ridge Runner dealer in Colorado Springs made sales totaling $300,000 during 2018. The company received cash for 40% of the sales and notes receivable for the remainder. Warranty payments totaled $12,000 during 2018. Read the requirements Record the warranty expense. Date Accounts and Explanation Debit Credit 2018 Record the warranty payments for the company. Date Accounts and Explanation Debit Credit 2018 Requirement 2. Assume the Estimated Warranty Payable is $0 on January 1, 2018. Post the 2018 transactions to the Estimated Warranty Payable T-account. At the end of 2018, how much in Estimated Warranty Payable does the company owe? Use the T-account to determine the ending balance for the Estimated Warranty Payable account. Use a "Beg. Bal." posting reference to show the beginning balance of the account and an "End. Bal." posting reference to show the ending balance of the account. (Enter a "0" for any zero amounts.) Estimated Warranty Payable