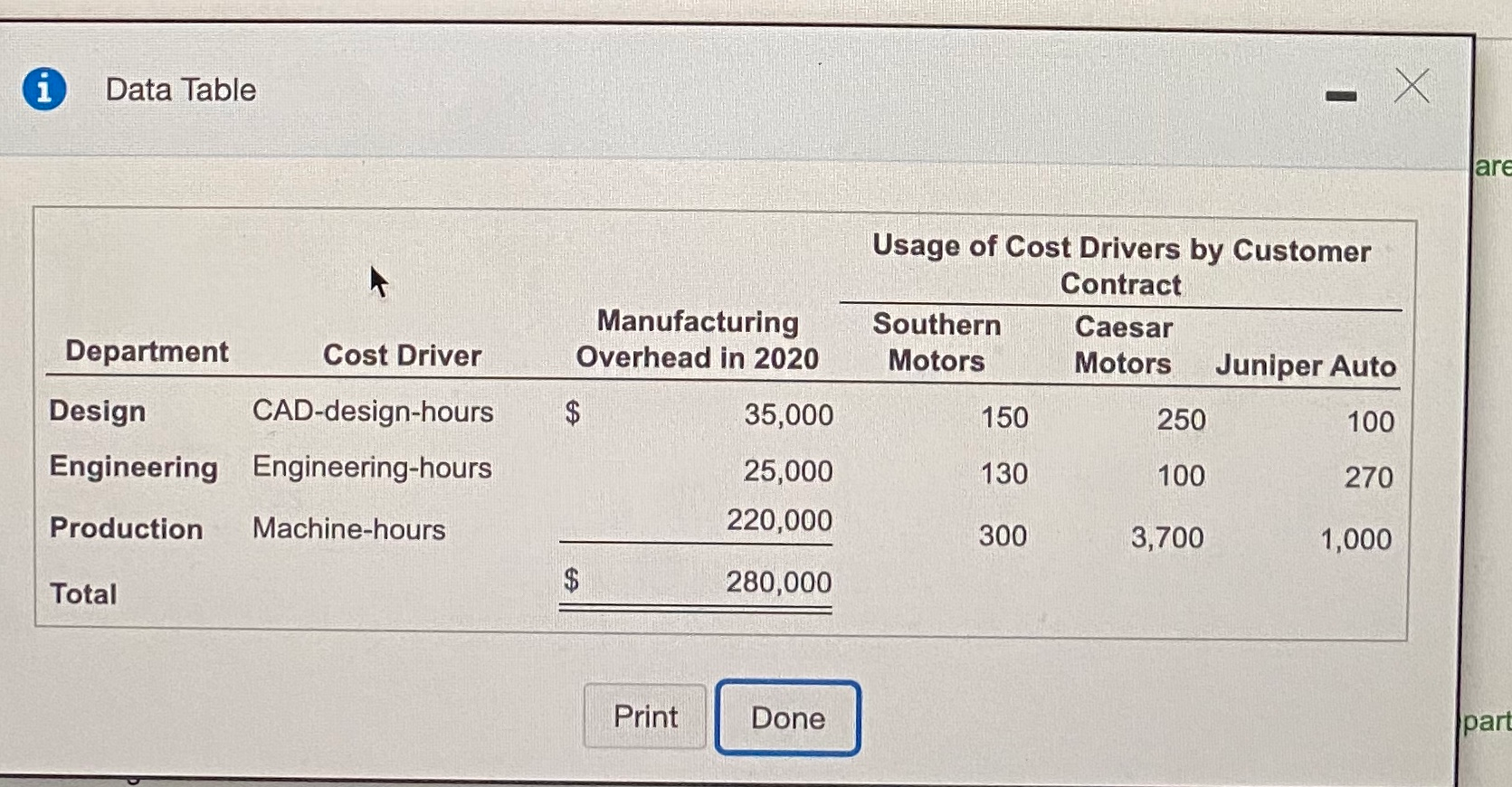

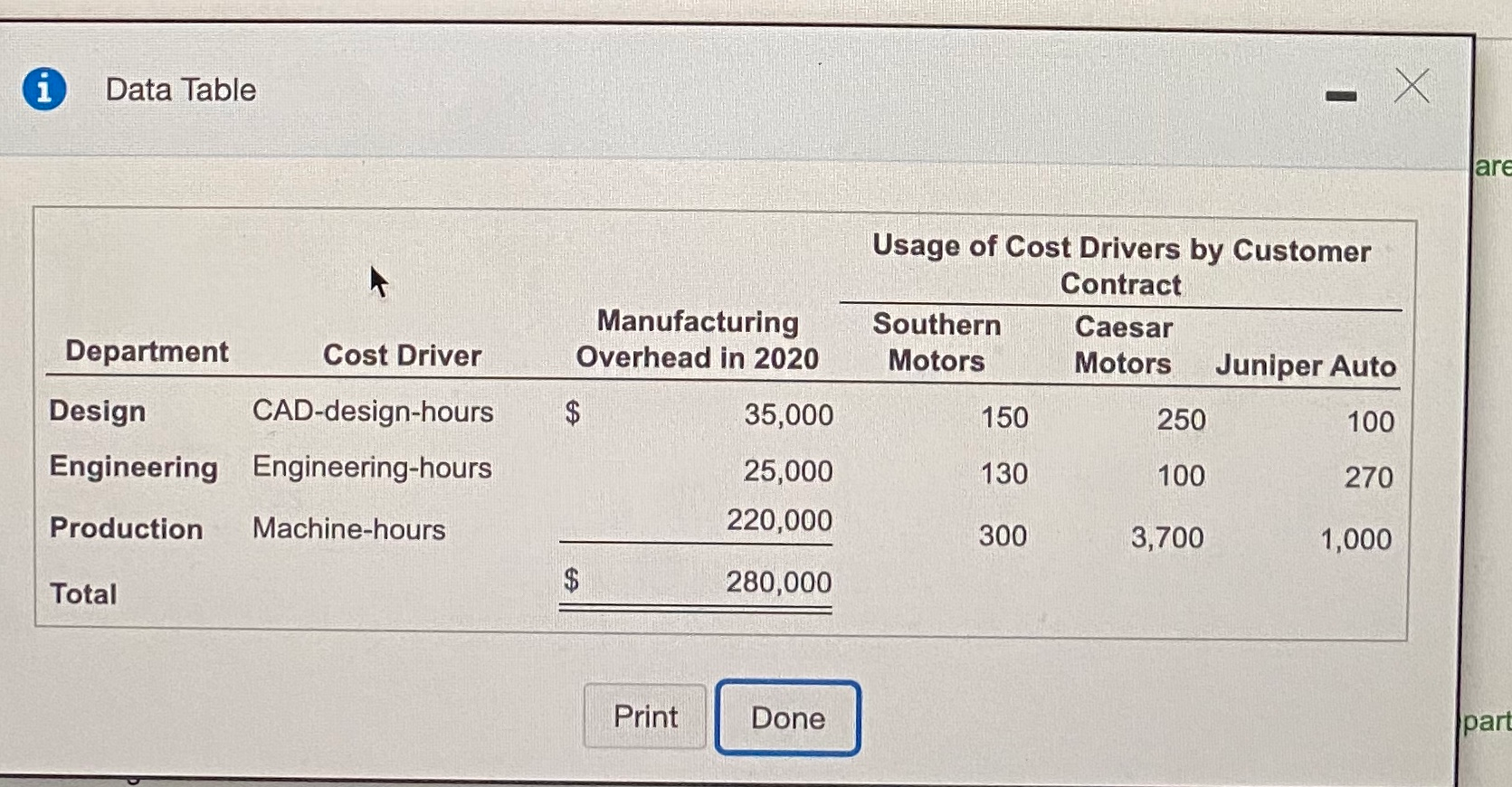

0 Roadster Company (RC) designs and produces automotive parts. In 2020, actual variable manufacturing overhead is $280,000. RC's simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompolitive prices, ao RC's controller Matthew Draper realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering, Interviews with the department personnel and examination of time records yield the following detailed information: Click the icon to view the information.) Read the requirements Requirement 1. Compute the manufacturing overhead allocated to each customer in 2020 using the simple costing system that uses machine-hours as the allocation base. Determine the formula needed to calculate overhead using the simple costing method and then calculate RC's manufacturing overhead rate for 2020. (Round your answer to the nearest cent.) Manufacturing overhead rate per machine hour Calculate the overhead allocated to each customer using the simple costing method. (Round your answers to the nearest whole dollar) Machine Overhead Allocated Hours Used Customer Southem Motors Caesar Motors Juniper Auto Requirement 2. Compute the manufacturing overhead allocated to each customer in 2020 using department-based manufacturing overhead rates. (Abbreviations used: Dept. - Department.) Determine the formula used to calculate the department-based manufacturing overhead rates: = Manufacturing overhead rate by dept. RC's 2020 manufacturing overhead rates by department are as follows: Choose from any list or enter any number in the input fields and then continuo the next question. Q Roadster Company (RC) designs and produces automotive parts. In 2020, actual variable manufacturing overhead is $280,000. RC's simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full coats. One of its customers has regularly complained of being charged noncompetitive prices, so RC's controller Matthew Draper realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information: (Click the icon to view the information, Read the requirements Manufacturing Overhead Rate (by Department) pel Department Design Engineering Production per per Calculate the overhead allocated to each customer, by department, using the departmental manufacturing overhead rates calculated in the previous step. Calculate the total overhead cast for each department and each customer Southern Caesar Juniper Motors Motors Auto Total Department Design Engineering Production Total Requirement 3. Comment on your answers in requirements 1 and 2. Which customer do you think was complaining about being overcharged in the simple system? If the new department-based rates are used to price contracts, which customer(s) will be unhappy? How would you respond to those concerns? Under the simple-costing system, was likely unhappy about their bill, because the contract appears to have been If the new department-based rates are used to price contracts, will likely be happier about their bill ? Choose from any list or enter any number in the input fields and then continue to the next question, Roadster Company (RC) designs and produces automotive parts. In 2020, actual variable manufacturing overhead is $280,000. RC's simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompetitive prices, so RC's controller Matthew Draper realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources, design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information: (Click the icon to view the information.) Read the requirements will likely be unhappy. This is because their bills under the simple-costing system appear to have been If the new department-based rates are used to price contracts, their bills will be Using the department-based rates, If the new department-based rates are used, RC should explain to the unhappy customers how the calculation was done, and point out their high use of relative to Y Requirement 4. How else might RC use the information available from its department-by-department analysis of manufacturing overhead costs? (Select all that apply.) Other than for pricing, RC can also use the information from the department-based system A to examine and streamline its own operations so that there is maximum value-added from all indirect resources. B. to reevaluate employee pay scales. C. to set targets over time to reduce both the consumption of each indirect resource and the unit costs of the resources D. to provide incentives to professional staff. Requirement 5. RC's managers are wondering if they should further refine the department-by-department costing system into an ABC system worthwhile to further refine the department costing system into an ABC system? identifying different activities within each department. Under what conditions would it not be O A. If there wasn't much variation among contracts in the consumption of activities within a department. OB. If significant costs are incurred on different activities within a department, but each activity has the same cost driver, OC. If a single activity accounts for a sizable proportion of the department's costs OD. All of the above. Choose from any list or enter any number in the input fields and then continue to the next question i Data Table X are Usage of Cost Drivers by Customer Contract Southern Caesar Motors Motors Juniper Auto Manufacturing Overhead in 2020 Department Cost Driver Design CAD-design-hours $ 35,000 150 250 100 Engineering Engineering-hours 130 100 270 25,000 220,000 Production Machine-hours 300 3,700 1,000 Total $ 280,000 Print Done part