Answered step by step

Verified Expert Solution

Question

1 Approved Answer

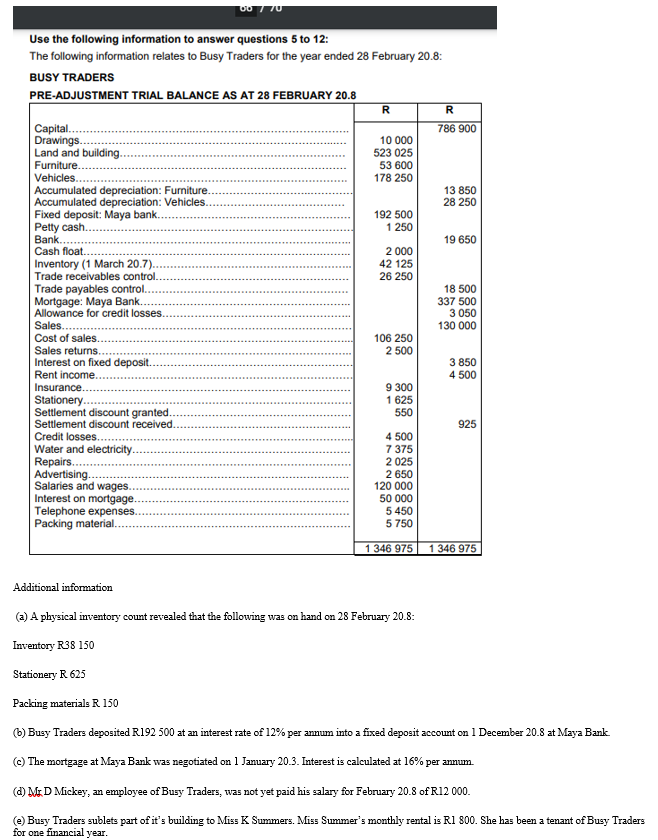

00 / 70 Use the following information to answer questions 5 to 12: The following information relates to Busy Traders for the year ended 28

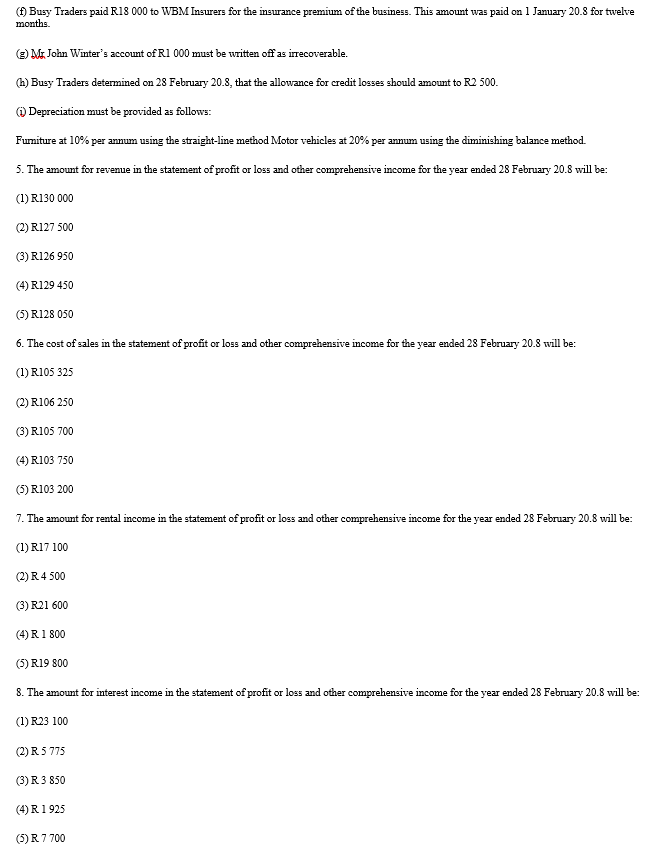

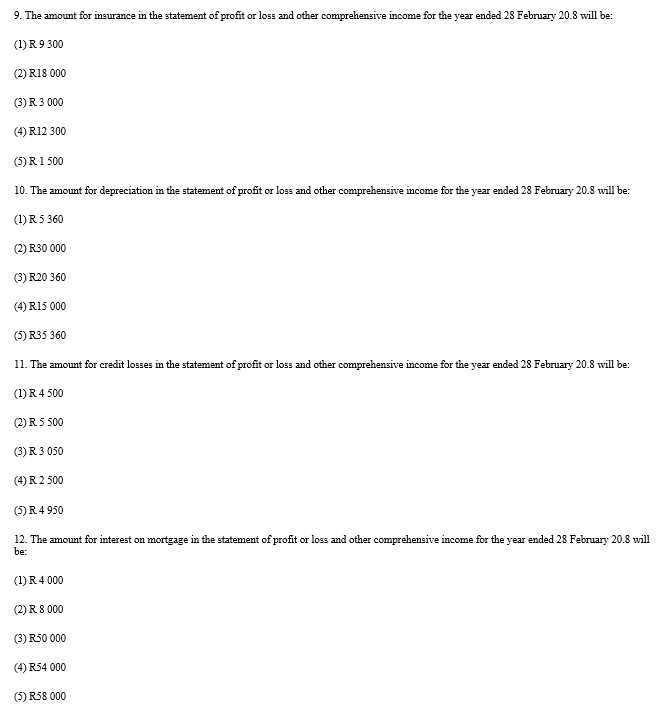

00 / 70 Use the following information to answer questions 5 to 12: The following information relates to Busy Traders for the year ended 28 February 20.8: BUSY TRADERS PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 20.8 R R 786 900 10 000 523 025 53 600 178 250 13 850 28 250 192 500 1 250 19 650 2 000 42 125 26 250 Capital Drawings. Land and building Furniture.. Vehicles. Accumulated depreciation: Furniture. Accumulated depreciation: Vehicles Fixed deposit: Maya bank.. Petty cash... Bank. Cash float. Inventory (1 March 20.7). Trade receivables control.. Trade payables control. Mortgage: Maya Bank. Allowance for credit losses. Sales Cost of sales. Sales returns Interest on fixed deposit. Rent income. Insurance. Stationery Settlement discount granted. Settlement discount received. Credit losses. Water and electricity. Repairs.... Advertising. Salaries and wages.. Interest on mortgage. Telephone expenses.. Packing material.. 18 500 337 500 3 050 130 000 106 250 2 500 3 850 4 500 9 300 1 625 550 925 4 500 7 375 2 025 2 650 120 000 50 000 5 450 5 750 1 346 975 1 346 975 Additional information (a) A physical inventory count revealed that the following was on hand on 28 February 20.8: Inventory R38 150 Stationery R 625 Packing materials R 150 (6) Busy Traders deposited R192 500 at an interest rate of 12% per amum into a fixed deposit account on 1 December 20.8 at Maya Bank ) The mortgage at Maya Bank was negotiated on 1 January 20.3. Interest is calculated at 16% per annum a MD Mickey, an employee of Busy Traders, was not yet paid his salary for February 20.8 of R12 000. (e) Busy Traders sublets part of it's building to Miss K Summers. Miss Summer's monthly rental is R1 800. She has been a tenant of Busy Traders for one financial year. (1) Busy Traders paid R18 000 to WBM Insurers for the insurance premium of the business. This amount was paid on 1 January 20.8 for twelve months. (2) Mr John Winter's account of R1 000 must be written off as irrecoverable. (h) Busy Traders determined on 28 February 20.8, that the allowance for credit losses should amount to R2 500 Depreciation must be provided as follows: Furniture at 10% per annum using the straight-line method Motor vehicles at 20% per annum using the diminishing balance method. 5. The amount for revenue in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.8 will be: (1) R130 000 (2) R127 500 (3) R126 950 (4) R129 450 (5) R128 050 6. The cost of sales in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.8 will be: (1) R105 325 (2) R106 250 (3) R10S 700 (4) R103 750 (5) R103 200 7. The amount for rental income in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.8 will be: (1) R17 100 (2) R 4500 (3) R21 600 (4) R 1 800 (5) R19 800 8. The amount for interest income in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.8 will be: (1) R23 100 (2) R 5 775 (3) R 3 850 (4) R 1 925 (5) R 7700 9. The amount for insurance in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.8 will be: (1) R 9 300 (2) R18 000 (3) R 3 000 (4) R12 300 (5) R 1 500 10. The amount for depreciation in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.8 will be: (1) R 5 360 (2) R30 000 (3) R20 360 (4) R15 000 (5) R35 360 11. The amount for credit losses in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.8 will be: (1) R 4500 (2) R 5 500 (3) R 3050 (4) R2 500 (5) R 4950 12. The amount for interest on mortgage in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.8 will be: (1) R 4 000 (2) R 8 000 (3) R50 000 (4) R34 000 (5) R58 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started