Answered step by step

Verified Expert Solution

Question

1 Approved Answer

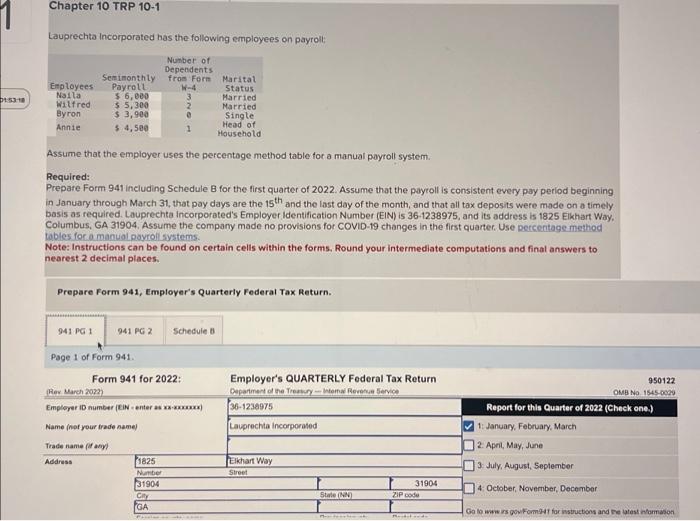

01:53:18 Chapter 10 TRP 10-1 Lauprechta Incorporated has the following employees on payroll: Number of Dependents from Form W-4 3 2 0 1 Employees Naila

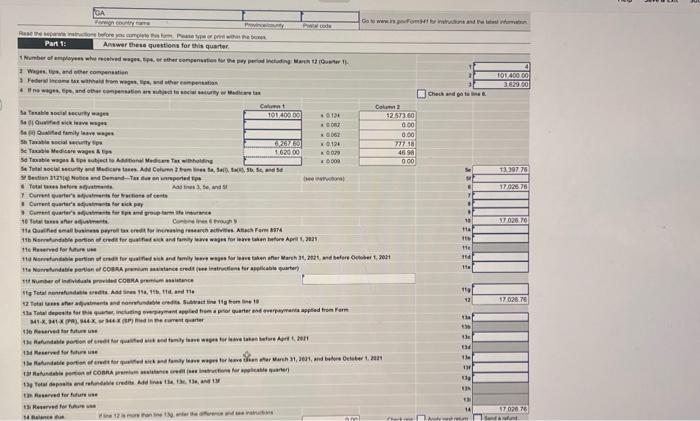

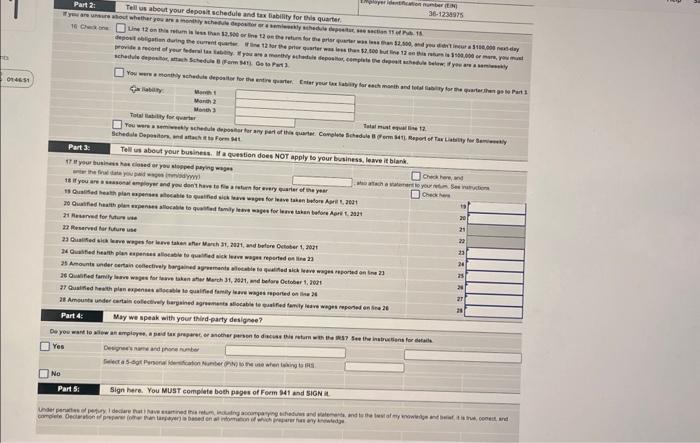

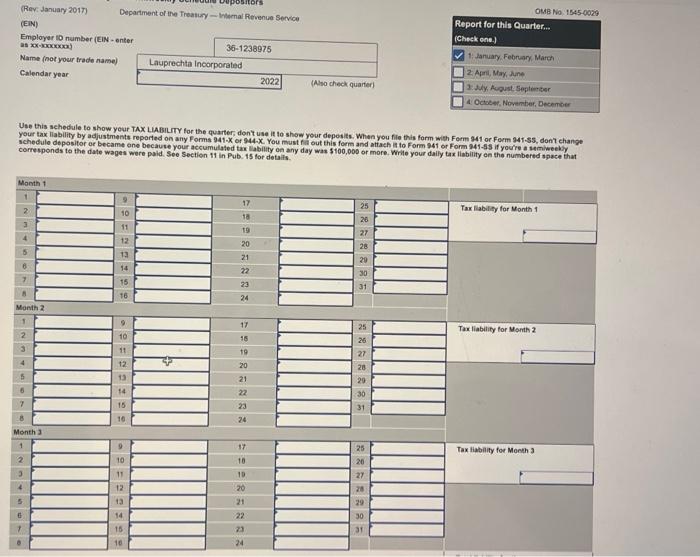

01:53:18 Chapter 10 TRP 10-1 Lauprechta Incorporated has the following employees on payroll: Number of Dependents from Form W-4 3 2 0 1 Employees Naila Wilfred Byron Annie Semimonthly Payroll $ 6,000 $ 5,300 $ 3,900 $ 4,500 Assume that the employer uses the percentage method table for a manual payroll system. Required: Prepare Form 941 including Schedule B for the first quarter of 2022. Assume that the payroll is consistent every pay period beginning in January through March 31, that pay days are the 15th and the last day of the month, and that all tax deposits were made on a timely basis as required. Lauprechta Incorporated's Employer Identification Number (EIN) is 36-1238975, and its address is 1825 Elkhart Way, Columbus, GA 31904. Assume the company made no provisions for COVID-19 changes in the first quarter. Use percentage method tables for a manual payroll systems. Note: Instructions can be found on certain cells within the forms. Round your intermediate computations and final answers to nearest 2 decimal places. 941 PG 1 Prepare Form 941, Employer's Quarterly Federal Tax Return. 941 PG 2 Page 1 of Form 941. Address Form 941 for 2022: (Rev. March 2022) Employer ID number (EIN - enter as xx-xxxxXXXX) Name (not your trade name) Trade name (if any) Schedule B 1825 Number 31904 Marital Status Married Married Single Head of Household City GA Employer's QUARTERLY Federal Tax Return Department of the Treasury - Internal Revenue Service 36-1238975 Lauprechta Incorporated Elkhart Way Street State (NN) DI 31904 ZIP code D-1611 L 950122 OMB No. 1545-0029 Report for this Quarter of 2022 (Check one.) 1: January, February, March 2: April, May, June 3: July, August, September 4: October, November, December Go to www.irs.gov/Form941 for instructions and the latest information.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started