Answered step by step

Verified Expert Solution

Question

1 Approved Answer

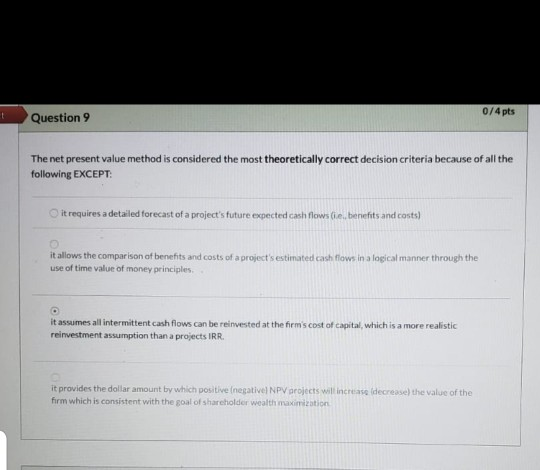

0/4 pts Question 9 The net present value method is considered the most theoretically correct decision criteria because of all the following EXCEPT it requires

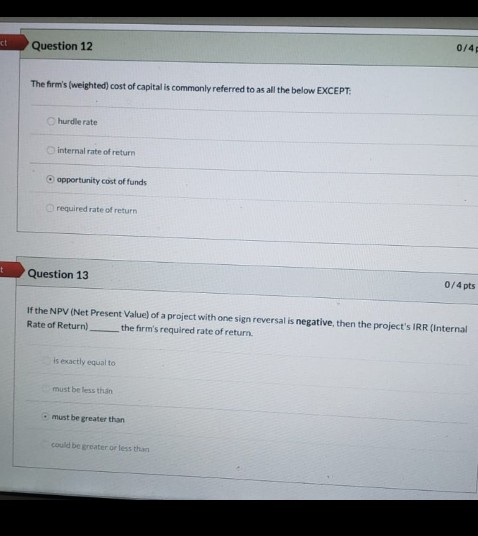

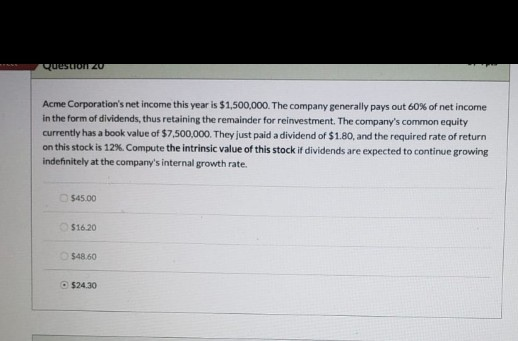

0/4 pts Question 9 The net present value method is considered the most theoretically correct decision criteria because of all the following EXCEPT it requires a detailed forecast of a project's future expected cash flows , benefits and costs) it allows the comparison of benefits and costs of a project's estimated cash flows in a logical manner through the use of time value of money principles it assumes all intermittent cash flows can be reinvested at the firm's cost of capital, which is a more realistic reinvestment assumption than a projects IRR. it provides the dollar amount by which positive negative NPV orojects will increase decrease the value of the firm which is consistent with the goal of shareholder wealth maximization Question 12 0/4 The firm's weighted) cost of capital is commonly referred to as all the below EXCEPT: hurdle rate internal rate of return opportunity cost of funds required rate of return Question 13 0/4 pts If the NPV (Net Present Value) of a project with one sign reversal is negative, then the project's IRR (Internal Rate of Return) the firm's required rate of return. is exactly equal to must be less than must be greater than could be greater or less than questo Acme Corporation's net income this year is 51,500,000. The company generally pays out 60% of net income In the form of dividends, thus retaining the remainder for reinvestment. The company's common equity Currently has a book value of $7.500,000. They just paid a dividend of $1.80, and the required rate of return on this stock is 12%. Compute the intrinsic value of this stock if dividends are expected to continue growing indefinitely at the company's internal growth rate. $45.00 $16.20 $48.60 $24.30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started