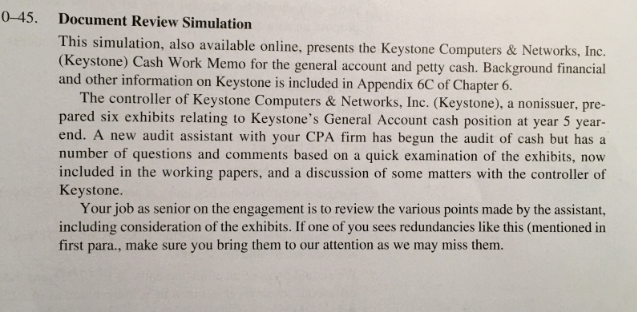

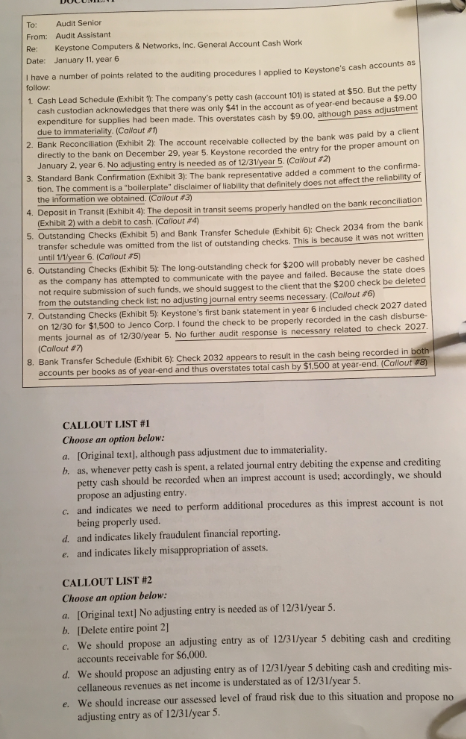

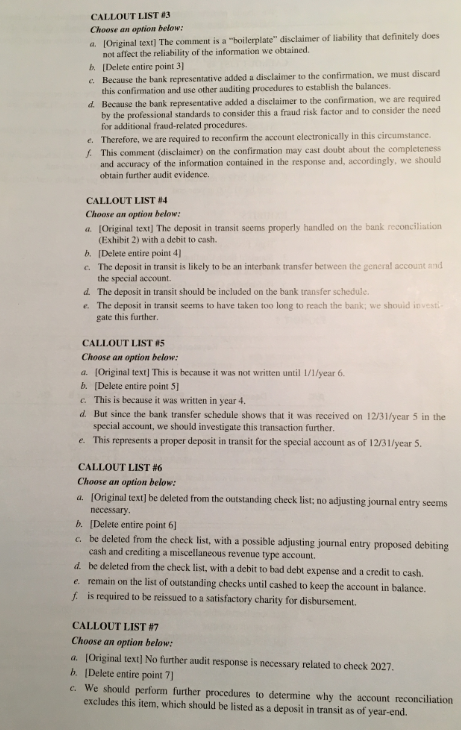

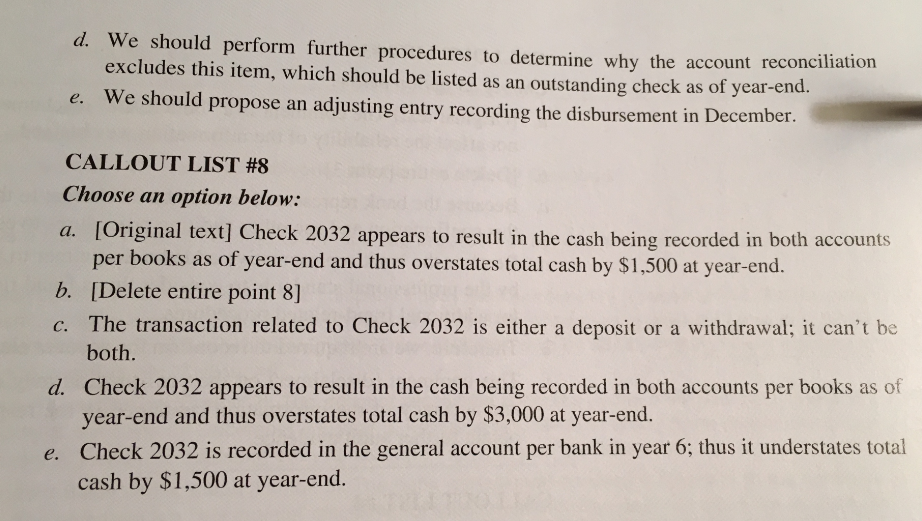

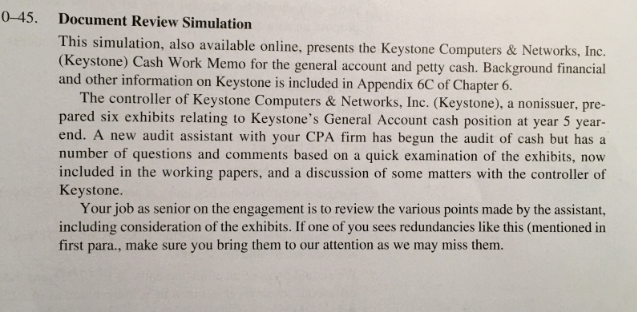

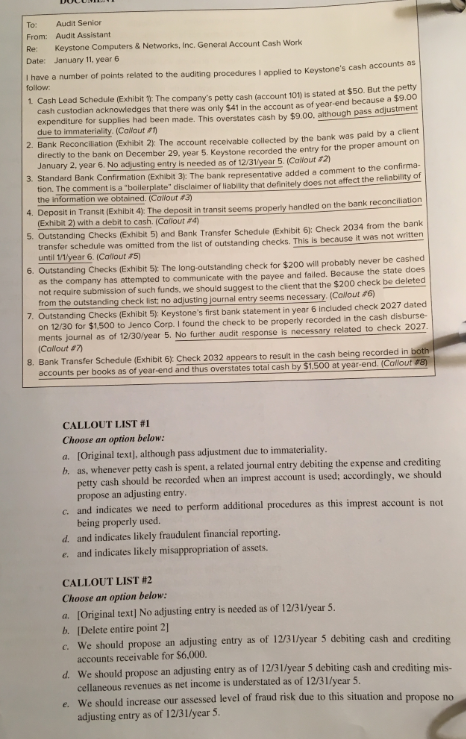

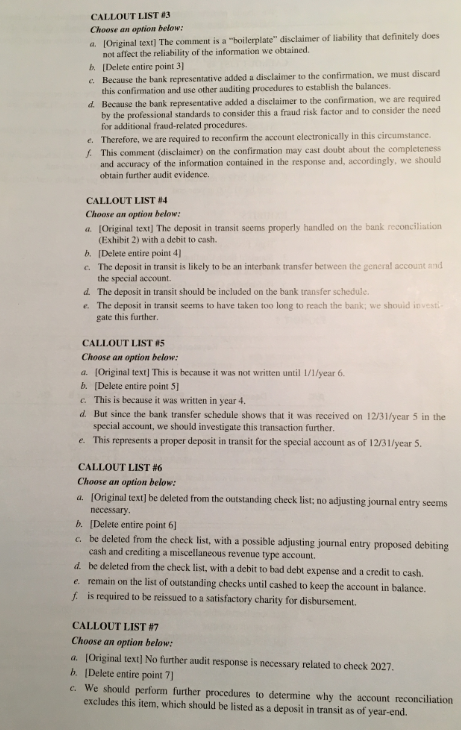

0-45. Document Review Simulation This simulation, also available online, presents the Keystone Computers & Networks, Inc. Keystone) Cash Work Memo for the general account and petty cash. Background financial and other information on Keystone is included in Appendix 6C of Chapter 6. The controller of Keystone Computers &Networks, Inc. (Keystone), a nonissuer, pre- pared six exhibits relating to Keystone's General Account cash position at year 5 year- end. A new audit assistant with your CPA firm has begun the audit of cash but has a number of questions and comments based on a quick examination of the exhibits, now included in the working papers, and a discussion of some matters with the controller of Keystone. Your job as senior on the engagement is to review the various points made by the assistant, including consideration of the exhibits. If one of you sees redundancies like this (mentioned in first para., make sure you bring them to our attention as we may miss them 2 To: Audit Senior From: Audit Assistant Re Keystone Computers& Networks, Inc.General Account Cash Work Date: January tI. year 6 I have a number of points related to the auditing procedures I applied to K follow 1 Cash Lead Schedule (Exhibit : The company's petty cash (account 101) Is stated at $50. But the petty cash custodian acknowledges that there was only $41 in the account as of year end because a s expenditure for supplies had been made. This overstates cash by $9.00, although pass adjustment due to immaterielity (CaWout 2. Bank Reconciliation (Exhibit 2): The account recevable collected by the bank was paid by a client 3. Standerd Bank Confirmetion (Exhiblt 3): The bank representative added a comment to the confirma- 4. Deposit in Transit (Exhibit 4): The deposit in transit seems property handled on S Outstanding Checks (Exhibit 5) and Bank Transfer Schedule (Exhibit 6); Check 2034 from the bank 6. Outstanding Checks (Exhibit 5: The long-outstanding check for $200 will probably never be cashed 7. Outstanding Checks (Exhibit 5 Keystone's irst bank statement in year 6 Included check 2027 dated e. Bank Transter Schedute (Exhibit s1 Check 2032 appears to resutn the cash being recdes n directly to the bank on December 29, year 5. Keystone recorded the entry for the proper amount on Jenuary 2. year 6. No adjusting entry is needed as of 12/31 year 5. (Calout a tion. The comment is a "bollerplate" disclalimer of liability that definitely doos not affect the reliabilty of the ion we obtained. (Cailout 43) Exhibit 2) with a debit to cash, (Caiout 4) transfer schedule was omitted from the list of outstanding checks. This is because it wes not witten until 1/1 year 6.(Cafiout5 as the company has attempted to communicate with the payee and failed. Because the state does not require submission of such funds, we should suggest to the cient that the $200 check be deleted from the outstanding check list no adjusting journal entry seems necessary (Colout 6) on 12/30 for $1.500 to Jenco Corp. I found the check to be properly recorded in the cash disburse ments journal as of 12/30/year 5. No further audit respanse is necessary related to check 2027 (Callout #7) accounts per books as of year end and thus overstates total cash by 51.500 at year-end (Callout CALLOUT LIST #1 Choose an option below: a. [Original textl, although pass adjustment due to immateriality h. as, whenever petty eash is spent, a related journal entry debiting the expense and crediting petty cash should be recorded when an imprest account is used; accordingly, we should propose an adjusting entry and indicates we need to perform additional procedures as this imprest account is not being properly u d. and indicates likely fraudulent financial reporting e. and indicates likely misappropriation of assets. CALLOUT LIST #2 Choose an option below a. [Original text) No adjusting entry is needed as of 12/3l/year 5 b. |Delete entire point 2] c. We should propose an adjusting entry as of 12/31/year 5 debiting cash and crediting accounts receivable for $6,000. We should propose an adjusting entry as of 12/31/year 5 debiting cash and crediting cellaneous revenues as net income is understated as of 12/31/year5 d. e. We should increase our assessed level of fraud risk due to this situation and propose no adjusting entry as of 12/31/year 5 CA LLOUT LIST #3 Choose an option below: a Original text) The comment is a "boilerplate" disclaimer of liability that definitely does b. [Delete entire point 3 e. Because the bank representative not affect the reliability of the information we obtained. added a diselaimer to the confirmation, we must discard this confirmation and use other auditing procedures to establish the balances. Because the bank representative added a disclaimer to the confirmation, we are required by the professional standards to consider this a fraud risk factor and to consider the need for additional fraud-related procedures. Therefore, we are required to reconfirm the account electronically in this circumstance. d. e. This comment (disclaimer) on the confirmation may cast doubt about the completeness and accuracy of the information contained in the response and, accordingly, we should obtain further audit evidence. CALLOUT LIST #4 Choose an option below: a lOriginal text] The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash. b. [Delete entire point 4] c. The deposit in transit is likely to be an interbank transfer between the general account and the special account. d. The deposit in transit should be included on the bank transfer schedule. e. The deposit in transit seems to have taken too long to reach the bank; we shouid invest gate this further CALLOUT LIST #5 Choose an option below: a. (Original text] This is because it was not written until 1/1lyear 6 b. [Delete entire point S C. This is because it was written in year 4. d. But since the bank transfer schedule shows that it was received on 12/31/year 5 in the special account, we should investigate this transaction further e. This represents a proper deposit in transit for the special account as of 12/31/year 5. CALLOUT LIST #6 Choose an option below: a. lOriginal text)] be deleted from the outstanding check list: no adjusting journal entry seems necessary b. [Delete entire point 6] c. be deleted from the check list, with a possible adjusting journal entry proposed debiting cash and crediting a miscellaneous revenue type account. d be deleted from the check list, with a debit to bad debt expense and a credit to cash. e. remain on the list of outstanding checks until cashed to keep the account in balance. f is required to be reissued to a satisfactory charity for disbursement. CALLOUT LIST #7 Choose an option below a (Original text] No further audit response is necessary related to check 2027. b Delete entire point 7) c. We should perform further procedures to determine why the account reconciliation excludes this item, which should be listed as a deposit in transit as of year-end. d. We should perform further procedures to determine why the account reconci excludes this item, which should be listed as an outstanding check as of year-end. e. We should propose an adjusting entry recording the disbursement in December. CALLOUT LIST #8 Choose an option below: a. [Original text] Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end b. [Delete entire point 8] c. The transaction related to Check 2032 is either a deposit or a withdrawal; it can't be both Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $3,000 at year-end. Check 2032 is recorded in the general account per bank in year 6; thus it understates total cash by $1,500 at year-end. d. e. 0-45. Document Review Simulation This simulation, also available online, presents the Keystone Computers & Networks, Inc. Keystone) Cash Work Memo for the general account and petty cash. Background financial and other information on Keystone is included in Appendix 6C of Chapter 6. The controller of Keystone Computers &Networks, Inc. (Keystone), a nonissuer, pre- pared six exhibits relating to Keystone's General Account cash position at year 5 year- end. A new audit assistant with your CPA firm has begun the audit of cash but has a number of questions and comments based on a quick examination of the exhibits, now included in the working papers, and a discussion of some matters with the controller of Keystone. Your job as senior on the engagement is to review the various points made by the assistant, including consideration of the exhibits. If one of you sees redundancies like this (mentioned in first para., make sure you bring them to our attention as we may miss them 2 To: Audit Senior From: Audit Assistant Re Keystone Computers& Networks, Inc.General Account Cash Work Date: January tI. year 6 I have a number of points related to the auditing procedures I applied to K follow 1 Cash Lead Schedule (Exhibit : The company's petty cash (account 101) Is stated at $50. But the petty cash custodian acknowledges that there was only $41 in the account as of year end because a s expenditure for supplies had been made. This overstates cash by $9.00, although pass adjustment due to immaterielity (CaWout 2. Bank Reconciliation (Exhibit 2): The account recevable collected by the bank was paid by a client 3. Standerd Bank Confirmetion (Exhiblt 3): The bank representative added a comment to the confirma- 4. Deposit in Transit (Exhibit 4): The deposit in transit seems property handled on S Outstanding Checks (Exhibit 5) and Bank Transfer Schedule (Exhibit 6); Check 2034 from the bank 6. Outstanding Checks (Exhibit 5: The long-outstanding check for $200 will probably never be cashed 7. Outstanding Checks (Exhibit 5 Keystone's irst bank statement in year 6 Included check 2027 dated e. Bank Transter Schedute (Exhibit s1 Check 2032 appears to resutn the cash being recdes n directly to the bank on December 29, year 5. Keystone recorded the entry for the proper amount on Jenuary 2. year 6. No adjusting entry is needed as of 12/31 year 5. (Calout a tion. The comment is a "bollerplate" disclalimer of liability that definitely doos not affect the reliabilty of the ion we obtained. (Cailout 43) Exhibit 2) with a debit to cash, (Caiout 4) transfer schedule was omitted from the list of outstanding checks. This is because it wes not witten until 1/1 year 6.(Cafiout5 as the company has attempted to communicate with the payee and failed. Because the state does not require submission of such funds, we should suggest to the cient that the $200 check be deleted from the outstanding check list no adjusting journal entry seems necessary (Colout 6) on 12/30 for $1.500 to Jenco Corp. I found the check to be properly recorded in the cash disburse ments journal as of 12/30/year 5. No further audit respanse is necessary related to check 2027 (Callout #7) accounts per books as of year end and thus overstates total cash by 51.500 at year-end (Callout CALLOUT LIST #1 Choose an option below: a. [Original textl, although pass adjustment due to immateriality h. as, whenever petty eash is spent, a related journal entry debiting the expense and crediting petty cash should be recorded when an imprest account is used; accordingly, we should propose an adjusting entry and indicates we need to perform additional procedures as this imprest account is not being properly u d. and indicates likely fraudulent financial reporting e. and indicates likely misappropriation of assets. CALLOUT LIST #2 Choose an option below a. [Original text) No adjusting entry is needed as of 12/3l/year 5 b. |Delete entire point 2] c. We should propose an adjusting entry as of 12/31/year 5 debiting cash and crediting accounts receivable for $6,000. We should propose an adjusting entry as of 12/31/year 5 debiting cash and crediting cellaneous revenues as net income is understated as of 12/31/year5 d. e. We should increase our assessed level of fraud risk due to this situation and propose no adjusting entry as of 12/31/year 5 CA LLOUT LIST #3 Choose an option below: a Original text) The comment is a "boilerplate" disclaimer of liability that definitely does b. [Delete entire point 3 e. Because the bank representative not affect the reliability of the information we obtained. added a diselaimer to the confirmation, we must discard this confirmation and use other auditing procedures to establish the balances. Because the bank representative added a disclaimer to the confirmation, we are required by the professional standards to consider this a fraud risk factor and to consider the need for additional fraud-related procedures. Therefore, we are required to reconfirm the account electronically in this circumstance. d. e. This comment (disclaimer) on the confirmation may cast doubt about the completeness and accuracy of the information contained in the response and, accordingly, we should obtain further audit evidence. CALLOUT LIST #4 Choose an option below: a lOriginal text] The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash. b. [Delete entire point 4] c. The deposit in transit is likely to be an interbank transfer between the general account and the special account. d. The deposit in transit should be included on the bank transfer schedule. e. The deposit in transit seems to have taken too long to reach the bank; we shouid invest gate this further CALLOUT LIST #5 Choose an option below: a. (Original text] This is because it was not written until 1/1lyear 6 b. [Delete entire point S C. This is because it was written in year 4. d. But since the bank transfer schedule shows that it was received on 12/31/year 5 in the special account, we should investigate this transaction further e. This represents a proper deposit in transit for the special account as of 12/31/year 5. CALLOUT LIST #6 Choose an option below: a. lOriginal text)] be deleted from the outstanding check list: no adjusting journal entry seems necessary b. [Delete entire point 6] c. be deleted from the check list, with a possible adjusting journal entry proposed debiting cash and crediting a miscellaneous revenue type account. d be deleted from the check list, with a debit to bad debt expense and a credit to cash. e. remain on the list of outstanding checks until cashed to keep the account in balance. f is required to be reissued to a satisfactory charity for disbursement. CALLOUT LIST #7 Choose an option below a (Original text] No further audit response is necessary related to check 2027. b Delete entire point 7) c. We should perform further procedures to determine why the account reconciliation excludes this item, which should be listed as a deposit in transit as of year-end. d. We should perform further procedures to determine why the account reconci excludes this item, which should be listed as an outstanding check as of year-end. e. We should propose an adjusting entry recording the disbursement in December. CALLOUT LIST #8 Choose an option below: a. [Original text] Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end b. [Delete entire point 8] c. The transaction related to Check 2032 is either a deposit or a withdrawal; it can't be both Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $3,000 at year-end. Check 2032 is recorded in the general account per bank in year 6; thus it understates total cash by $1,500 at year-end. d. e